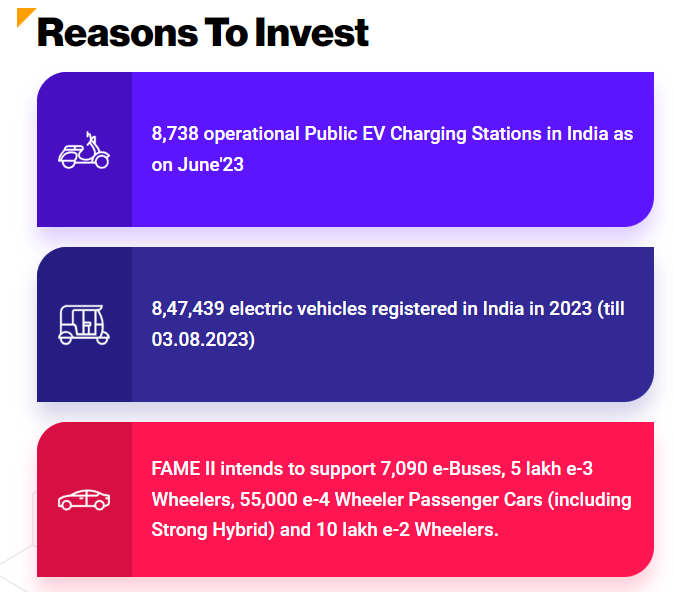

In this article, we find 3 Best Ev Stocks to Invest in. Well, investing in the 3 EV market sector could be really good for future growth and investment purposes because the Indian government is to have 30% of electric vehicles by 2030.

Some people ask, why is it mandatory to have an electric vehicle. The simple answer is that because diesel and petrol are too expensive and they are not good for the environment. That is why the government is also moving to electricity and electric vehicles so that we can maintain our environment.

EV Industry

Automobile the mobile sector, contributes 49% to the Indian manufacturing GDP and 7.1% to the Indian GDP and the second automobile mission plan is to be released by the government outline to elevate the automobile industry to the world-class level.

then, in the EV sector, there are some fundamentally strong companies that can give good returns

3 Best EV Stocks to Invest

1. Tata Motors

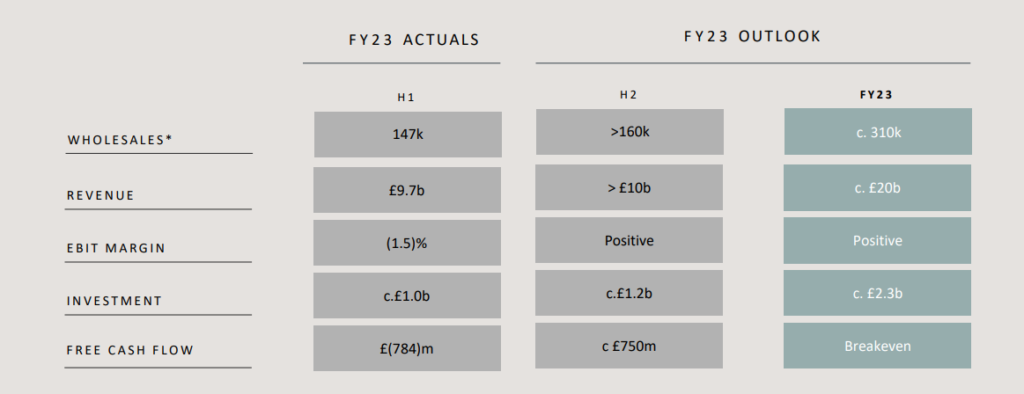

India, the EV sector, Tata Motors is a major player in the automobile sector. total revenue of this quarter has increased by 31.85% year on year and the EBITA of the Quarter increased by 120% year on year so the company did really good growth in revenue and then net income.

stock’s past six-month return is 30.15% and past one-year return is 60.10% and the last two-year return is 39.84%. It could be a good return and a stable return by Tata Motors.

Why Tata Motors Stock

- PE is really good 15.58

- The stock has bullish momentum above the short-term, medium, and long-term moving average

- if data suggest the long and winding today.

- And the stock is out for Tata Motors up by 5.02% versus Nifty up by 50 points means 2.7% in the last month.

- Mutual funds have increased the holding from 8.96% to 9.82% in the September quarter.

- Foreign institutional investors and the FPI increased the holding from 17.72% to 18.40% in the September quarter.

- Along with this, the number of investors also increased from 966 to 1036 in the September Quarter

2. Mahindra and Mahindra

Mahindra and Mahindra also have a really good balance sheet. They have had great sales growth in the past three years. Their compounded profit growth is 1043%. That is really really good and the return on equity in the past three years is 13% and the compounded sale growth in the past three years is 17%. The numbers are amazing and the company maintains more than 12% of OPM from the last 10 years.

Currently, the stock is trading at Rs 1,546. understand share, holding pattern for an institutional investor, increase their holding from 40.14% to 40.26% in September and the number of foreign institutional investors also increased from 1253 to 1304 in September.

Mahindra’s past six-month returns are 22.17% and the past one written is 25.82% that is considered to be really nice written if you compare it to the normal interest that you are getting from the RDand the past two returns are 71.61%.

why the Mahindra and Mahindra stock

- the annual profit of a company has increased in the last two years.

- FII increased their shareholding.

The brokerage firm also gave a target of Mahindra and Mahindra stock of 1700 and 1800.

3. Hero Moto Limited

You want to have a market cap of 66,889.24 crore. Hiromoto cop stock is currently trading at ₹3568 the stock gave a massive move of 4.52% in a single day.

The total revenue of this quarter has increased by 5.33% year on year and the net profit has increased this quarter by 46.17% year on year. The stock is in bullish, momentum trading of the short-term, medium, and long-term moving averages.

This is the outperformer that is up by 13.28% versus the Nifty 50 up by 2.7% in the last month.

In September there is a change in shareholding pattern like this. The mutual fund increased its shareholding from 10.33% to 12.49% in the September quarter. The number of foreign institutional investors increased from eight 874 to 876 in the September quarter, but the foreign institutional investor reduced their holding from 28.10% to 36.80% in September.

Disclaimer

we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

reference screener. in, money controls and invest in India.