Get ready to dive into an exhilarating journey as we unravel the captivating saga of Adani Port Share Price Targets. Buckle up, because we’re about to embark on a thrilling ride through the years 2025, 2030, 2040, and 2050!

Adani Ports is experiencing a sharp upward climb, but whether it’s a temporary surge or a sustained march towards 1200 remains to be seen. Analyzing recent developments, market sentiment, and potential growth drivers is crucial for discerning the future trajectory.

Let’s explore the future with excitement and anticipation! ??

Before investing you should know about the company’s balance sheet and how the companies performed in the last 5 years. What are the company’s sales? What are the experts’ opinions on the Adani port stock?

At the end of this article, you will have a clear understanding of the Adani port stock.

Adani Port Stock Target by Broker Research

| BROKER RESEARCH | Updated Date | Vedanta Share Price Target |

| ICICIdirect.com | 09 Aug 2022 | Rs 950 |

| ICICIdirect.com | 26 May 2022 | Rs 900 |

Adani Port Stock Overall Rating

| Source | BUY | HOLD | SELL | Total |

| Trading View | 15 | 0 | 0 | 15 |

| Economics Times | 20 | 0 | 0 | 20 |

| Money Control | 20 | 0 | 0 | 20 |

| Overall | 55 | 0 | 0 | 55 (100%) |

Adani Port overview

Adani Ports and Special Economic Zone Limited (APSEZ), a leading port operator in India, has emerged as a force to be reckoned with in the global maritime industry. With its immense growth potential and strategic acquisitions, APSEZ is poised to deliver substantial returns to investors in the coming years.

Adani Port Business Overview

- Largest private port operator in India: APSEZ operates 12 strategically located ports across the Indian coastline, handling over 247 million metric tonnes of cargo in FY 2022.

- Diversified cargo portfolio: APSEZ handles a diverse mix of cargo, including dry bulk, containers, liquid cargo, and crude oil, catering to various industries.

- Strong financial performance: APSEZ has consistently delivered robust financial performance, with a revenue of ₹16,691 crores (US$2.04 billion) and a net profit of ₹4,577 crores (US$561 million) in FY 2022.

- Strategic acquisitions and expansions: APSEZ has actively pursued strategic acquisitions and expansions, solidifying its position in the Indian port sector and expanding its global footprint.

- Focus on sustainability: APSEZ has undertaken various sustainability initiatives, including port modernization, renewable energy adoption, and waste management, to minimize its environmental impact.

| Company Name | Adani Ports and Special Economic Zone Ltd |

| Market Cap | ₹ 1,70,726.58 Cr. |

| P/E | 23.1 |

| Sector P/E | 20.0 |

| Debt to Equity ratio | 1.16 |

| ROE | 14.3 % |

| DEBT | ₹ 53,136 Cr. |

| Return over 3years | 33.9 % |

| Dividend Yield | 0.62 % |

| 52 Week High/Low | ₹ 988 / 395 |

| Website | http://www.adaniports.com/ |

The Adani port has India’s largest port network. Adani port stock’s past 3-month return and past 3-year return is 141.60%. which are considered a nice return from the stock. Adani Port’s stock price 2025 in is between Rs 1000 to 1500.

Adani port stop last 5 years written is 108.76%. If a stock gives the same return in the next 5 years then Adani Port’s share price target in 2030 is between Rs 2000. to ₹2900.

Adani port 82% of total revenue comes from the network of the port 8% comes from logistics 6% from seg and ports and 4% from operation and maintenance. As in the port industry, Adani Port is a leading company. Adani Port’s share price target in 2040 is between a minimum is Rs 4000 and a Maximum of Rs 5500.

In the past 5 years, the free cash flow growth was 83.87% versus industrial 64.42%. In the June quarter of 2023, the company’s total revenues increased by 7.19% EBITA increased by 70.64%, and net income by 82.48% which is very nice growth in this quarter by the Adani port. Adani Port maintains a healthy balance sheet then the share price target of Adani Port in 2025 is between a minimum of Rs 7000 to 8000.

| Years | Minimum Target | Maximum Target |

| 2025 | Rs 1000 | Rs 1500 |

| 2030 | Rs 2000 estimated | Rs 2900 estimated |

| 2040 | Rs 4000 Approx | Rs 5500 Approx |

| 2050 | Rs 7000 Appox | Rs 8000 Approx |

- Yes Bank Share Price Target in 2025

- Alstone Textiles Share Price Target 2025

- RVNL Share Price Target 2030

- Khoobsurat Share Price Target 2025

- Urja Global Share Price Target in 2030

- ITC Share Price Target 2025

- South Indian Bank Share Price Target 2025

- KPIT Tech Share Price Target 2025

- NCL Research Share Price Target 2025

Adani Port Targeted by experts

Trading view

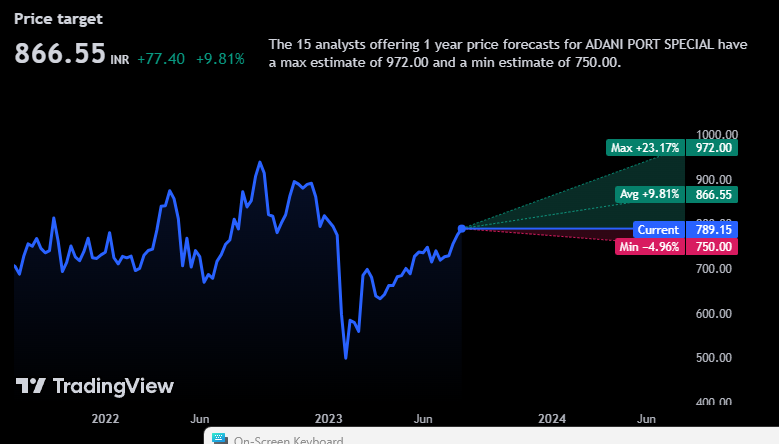

According to the trading view forecast 15 analysts give their reviews out of 15/15 have a buy.

According to the money control website

20 analysts have their reviews and 20 are bullish on the stock.

According to the Economic Times website

20 analyses have their views. 20 are bullish on a stock.

Conclusion

Adani Port maintains a healthy balance sheet and the sales growth profit growth stock return on equity all are good. The brokerage research also servicing their recent target is 950 according to the ICICI direct there servicing ₹900 target.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

FAQ

Which port is owned by Adani?

Mundra Port own by Adani?

Is Adani Port a debt-free company?

The net debt of Adani Ports and Special Economic Zone Limited was over 444 billion Indian rupees in the financial year 2023.