Ashok Leyland is a well-established brand name. Ashok Leyland is a manufacturer of commercial vehicles. The company is present in 50 countries.

With the help of this article, we Fully understand Ashok Leyland Share Price Target. Based on company fundamentals and past years’ returns, we predict the company’s share price.

Key Points

- Stock 3 Years returns 267.94%.

- Beat 3 Years of Revenue 23.47%.

- ROE is 15%.

Ashok Leyland Company Business

The company’s business is divided into three segments:

- Commercial Vehicles: Ashok Leyland manufactures a wide range of commercial vehicles, including trucks, buses, and light commercial vehicles. It also manufactures engines for commercial vehicles.

- Power Solutions: Ashok Leyland manufactures diesel engines for industrial, genset, and marine applications.

- Defense: Ashok Leyland manufactures a range of defense vehicles, including trucks, buses, and special-purpose vehicles.

Ashok Leyland Stock Target by Experts

| Broker | Updated Date | Target |

| Geofin Comtrade | 26 Jul 2023 | Rs 210 |

| ICICI Securities | 25 Jul 2023 | Rs 185 |

| Prabhudas Lilladher | 25 Jul 2023 | Rs 225 |

| LKP Securities Limited | 25 Jul 2023 | Rs 207 |

| KRChoksey | 07 Jul 2023 | Rs 194 |

| Prabhudas Lilladher | 16 Jun 2023 | Rs 215 |

| LKP Securities Limited | 24 May 2023 | Rs 186 |

Ashok Leyland Company Overview

Ashok Leyland is the flagship Company of the Hinduja group, having a long-standing presence in the domestic medium and heavy commercial vehicle (M&HCV) segment. The company has a strong brand, a well-diversified distribution and service network across the country, and a presence in 50 countries. It is one of the most fully integrated manufacturing companies. Its headquarters are in Chennai.

| Company Name | Ashok Leyland Ltd |

| Market Cap | ₹ 53,584.32 Cr. |

| Debt | ₹ 3,180.10 Cr. |

| ROE | 17.60 % |

| Sales Growth | 66.65% |

| ROCE | 21.38% |

| P/E | 28.37 |

| Sector P/E | 68.4 |

| 52 Week High/Low | ₹ 186 / 133 |

| Website | http://www.ashokleyland.com/ |

Related

- Yes Bank Share Price Target in 2025

- Alstone Textiles Share Price Target 2025

- RVNL Share Price Target 2030

- Khoobsurat Share Price Target 2025

- Urja Global Share Price Target in 2030

- ITC Share Price Target 2025

- South Indian Bank Share Price Target 2025

- KPIT Tech Share Price Target 2025

- NCL Research Share Price Target 2025

Ashok Leyland stock gives great returns to its investors. The past 3 months’ returns are 25.47%. Past 1-year returns are 25.09%. Ashok Leyland company operating profit is a really good company growing quarter on quarter basis.

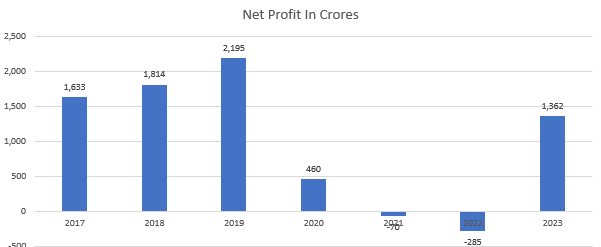

The net profit of the company in March 2023 was Rs 1362 Crores will be compared to the previous year the company booked a loss of Rs 285 Crores. Ashok Leyland Share Price Target is between Rs 250 and Rs 350 by 2025.

Ashok Leyland’s last 3 years’ returns are 267.94%. If the stock gives the same returns in the future.

The total revenue growth of Ashok Leyland company in 2021 and 2022 is 33.39% and in 2022 to 2023 that is really good is 58.94%. In 2030 the company made a net income of 752.73 crore. Ashok Leyland Share Price Target will be between Rs 650 and Rs 827.

The company manages driver training institutes across India and has trained over 8,00,000 drivers since inception. They are creating a good culture of education. Ashok Leyland Share Price Target in 2040 is between Rs 1500 to 1600.

Ashok Leyland manufactures Commercial Vehicles like M&HCV, LCV, M&HCV buses, and bus defense. In M&HCV truck segment revenue, 44% in FY2022. Ashok Leyland Share Price Target in 2050 is between Rs 3000 and 3500.

| Years | Minimum | Maximum |

| 2025 | Rs 250 | Rs 350 |

| 2030 | Rs 650 Approx | Rs 827 Approx |

| 2040 | Rs 1500 Approx | Rs 1600 Approx |

| 2050 | Rs 3000 Approx | Rs 3500 Approx |

Ashok Leyland’s Strengths and Weaknesses

Strength

- The debt-to ratio is High (3.64).

- Last Year’s ROE was 15%.

- FII increased Holding by 1.76%.

- Public Holding Reduced by 0.38%.

Weaknesses

- Quarterly Results are not Good.

- Past 5 years debt to equity ratio has been 256.1%, vs the industry average of 114.28%.

Expert Opinion on Ashok Leyland Stock

According to the trading website, 45 analysis of ring 1-year forecast for Ashok Leyland is a maximum of 240 rupay and a minimum is 140.

According to the Economics Times, 39 Analyst have their review 29 have a buy call and 6 Hold and 4 have sell.

Conclusion

The company has excellent brand value. the second-largest company in Commercial vehicle Manufacturing after Tata Motors. Ashok Leyland has a market cap of ₹53,584.32 crore. fundamentally strong Company.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

FAQ

Is Ashok Leyland’s share good for the long term?

Yes, Stock is good for the long term. Stock pas 3 years Returns 267.94%.

Is Ashok Leyland is Debt-free company?

No, Ashok Leyland has deb of ₹ 3,180.10 Cr.

What will be Ashok Leyland’s share price target in 2025?

Ashok Leyland’s Share Target in 2025 is between Rs 250 and Rs 350.