Banas Finance Company engages in finance, share trading investment, and Consultancy having an interest in reality business. Banas Finances was founded on the 6th of June 1983, and its Headquarters was located in Mumbai India.

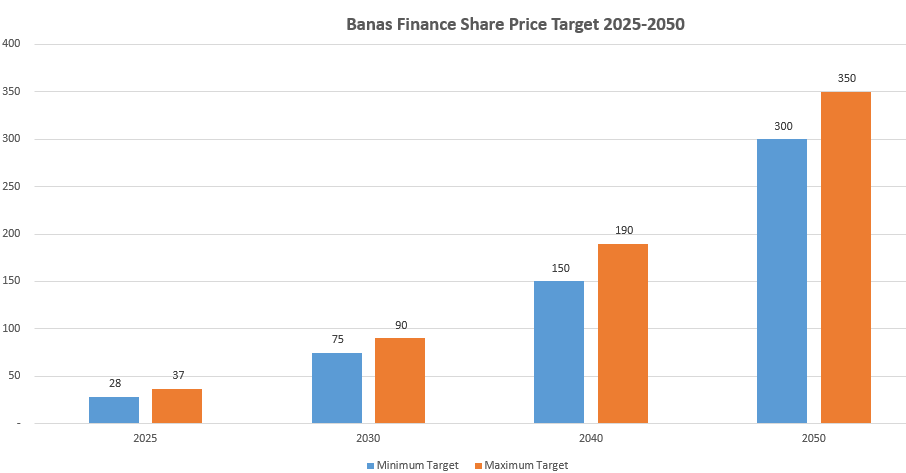

Banas Finance Share Price Target for 2025 in minimum is Rs 28 and the maximum is Rs 37.

Hello investors in this article, we are going to understand why Banas Finance Limited stock and company.

We will do a fundamental analysis of the banas finance. We will see how the Banas company is performing year on year (YOY) and what the company’s profit and loss statements of company. Based on the company, sales and compounding growth, and the stock return. We will analyze the stock’s future price.

We will also discuss the stock prices by the experts on the different websites.

Banas Finance Key Point

| Company Name | Banas Finance Ltd |

| Market Cap | ₹ 105 Cr. |

| Debt | ₹ 6.51 Cr. |

| P/E Ratio | 12.4 |

| Sector P/E | 24.3 |

| Debt to Equity ratio | 0.04 |

| ROE | -34.9 % |

| Dividend Yield | — |

| 52 Week High/Low | ₹ 25.0 / 9.77 |

| Return over 3years | 59.1 % |

| Website | https://banasfinance.wordpress.com/ |

if you see the return of bananas Finance in the past six months, that is 65.50% you could say really good returns are 10% month on month, and if you see the one-year returns that is a little bit less about 30.22%, and if you see the last two year returns that was also 30.38%.

So you can say the stock made a good roller coaster ride, so the stock could not give consistent returns as the stock gave in the last six months. The company is in the finance sector so there are many big players in the finance sector like Bajaj Finance, Bajaj, finance Jio Finance, and Shriram Finance due to this the company may face struggles in the future. Banas finance share price target for 2025 in minimum is Rs 28 and the maximum is Rs 37.

Jio Financial Share Price Target 2025

The stock is hitting the upper circuit and first of November and the first second of the number on both the first of the per circuit and trading at Rs 20.77.

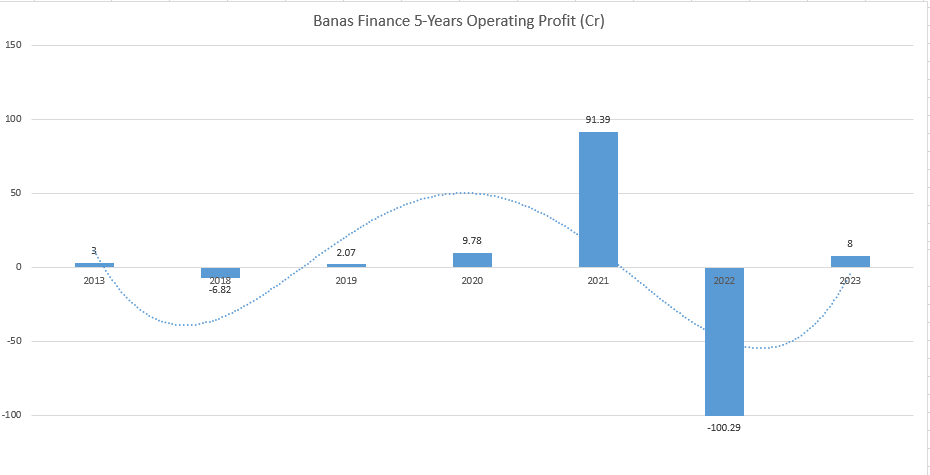

Banas Finance Stock’s past five-year operating profit was really bad in March 2019 the operating profit was -6.82 crore in the next consecutive three-year Company profit in March 2020 Company had an operating profit of 2.07 crore in March 2021 Company however operating profit of 9.78 crore in March 2022 the company has an operating profit of 91.39 but in March 2023, the company declared the operating loss of 100 crore. which cannot be considered good.

but still, if the Company makes a profit in the upcoming year the stock price could reach to Banas Finance Share Price Target for 2030 The minimum is Rs 75 and the Maximum is Rs 90.

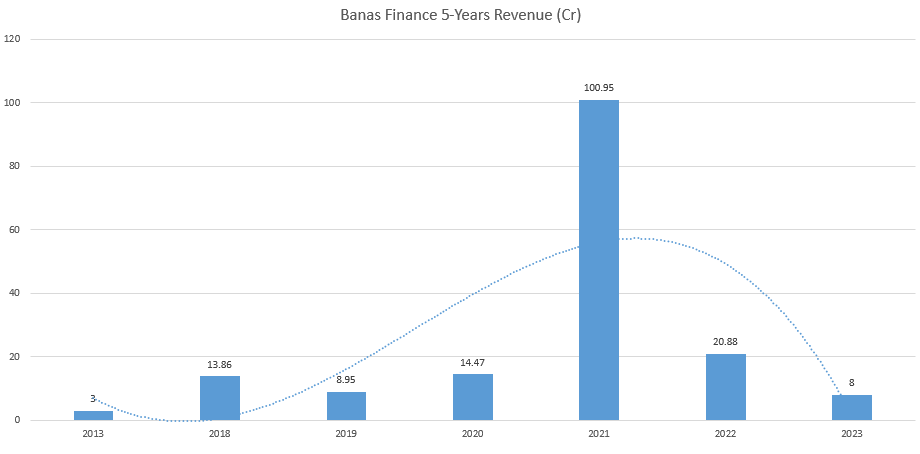

In the financial year 2023 total revenue of the company decreased by 79.3% but in the previous year 2021 2 financial 22 the total revenue increased by 597.65%.

if we compare by the industries, then the past five years, the company revenue growth averages 153.68% in the industry average is only 15.86%, but in net income companies net income is reduced in the past five years the company’s net average income is negative 597.98% versus the industry averages 62.35%.

From here, you can clearly see that the company is making good revenue, but not able to make a profit out of it, so maybe the company needs to improve its operations cycle or reduce its expenses. The Banas Finance Share Price Target for 2040 The minimum is Rs 150 and the maximum is Rs 190.

Well, looking for such a long period like 2015 could be really difficult to predict the exact price but we can make an estimate based on the company’s previous returns the company’s current financial condition, and the market condition where the company stands right now.

if we do the competitive releases of the company, then the company stays at the below, because the company is a finance sector, and already in the finance sector there the major players like Bajaj Finance, Jio Finance is a new player and Bajaj fan and Bajaj holding she around Finance so Company.

Based on this, the company may face tough times in the future. Sudha, roughly bonus, Banas Finance Share Price Target 2050 minimum can be estimated as Rs 300 and the maximum 350.

| Years | Minimum Target | Minimum Target |

| 2025 | Rs 28 | Rs 37 |

| 2030 | Rs 75 | Rs 90 |

| 2040 | Rs 150 Estimated | Rs 190 Estimated |

| 2050 | Rs 300 Estimated | Rs 350 Estimated |

Banas Finance Stock Strength and Weakness

Strength

- Currently, the stock in Up trends and the RSI also showing good strength.

- Company with a low debt

- stock of more than 20% in one month.

Weaknesses

- Company net profit has declined.

- The company, total revenues declined by 80%

- decline in companies, net cash flow what is your.

Conclusion

financially, if you see the company is not really stable financially, by 2023 the total revenue of the company will decline really badly; it’s about 80%. but currently stock in upper momentum. This is the highest recovery from the 52-week low and the stock piece is low. It’s about 10 and the RSI is also indicating a strength. These are some good signals in the stock.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

What is the 52-week high of Banas Finance?

The 52-week High of the bonus Finance is ₹25.

What is the share price target of Banas Finance for 2025?

Banas finance share price target for 2025 in minimum is Rs 28 and the maximum is Rs 37.

Is it a good time to invest in Banas stock?

currently, the Bus stock is in an uptrend 30 days SME, crossover, DMA, and the current price is written then open so it could be a good sign for the stock.