Hathway Cable and Datacom Limited, one of India’s leading cable television and broadband service providers, has witnessed a remarkable growth trajectory over the years.

With its strong market presence, innovative product offerings, and expanding customer base, Hathway is poised for continued success in the years to come.

In this article, we will delve into the factors driving Hathway’s growth potential and project its share price targets for 2025, 2030, 2040, and 2050.

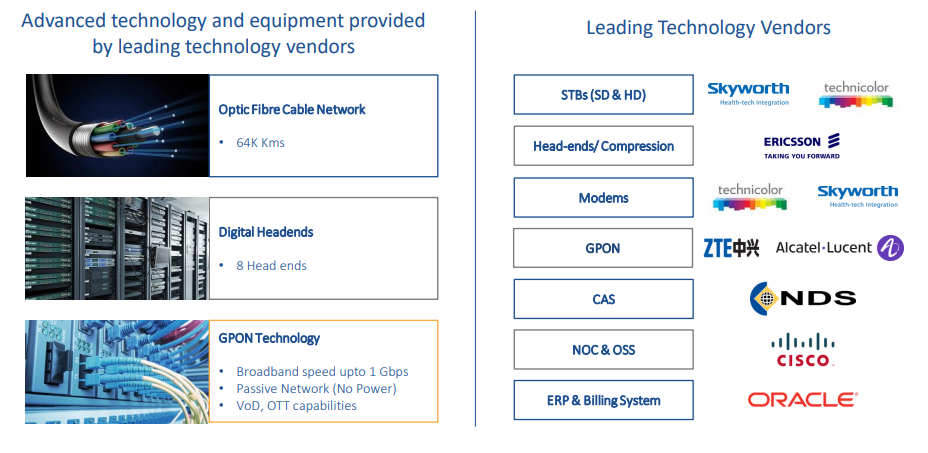

The company is a subsidiary of their land group business. I have a great market presence of 5.6 million digital cable distributors and a fiber cable network spending over a kilometer at an online collection rate of 96% along with a broadband optical fiber cable network of 73,000+ kilometers.

- Avance Technologies Share Price Target 2025

- Delta Corp Share Price Target 2025-2050

- Yes Bank Share Price Target in 2025

Hathway share price target is 2025 the minimum is Rs 23 and the Maximum is Rs 28.

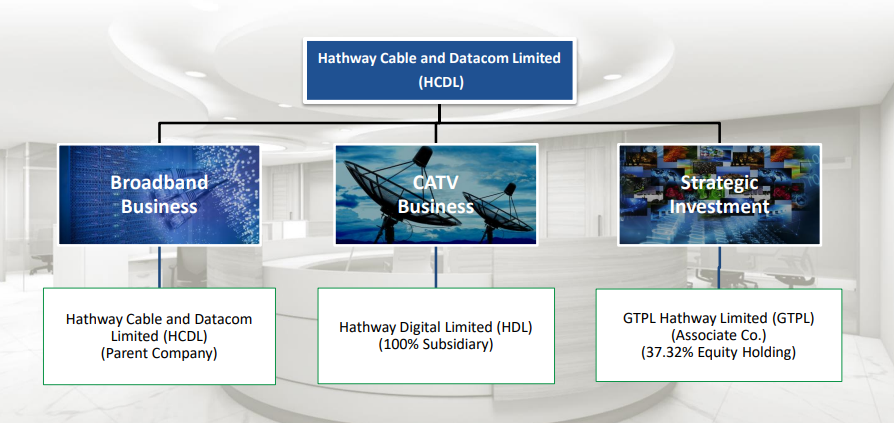

Hathaway Company Business Overview

Hathway is one of India’s leading cable TV and broadband service providers. It offers cable TV, high-speed broadband, and over-the-top (OTT) content services.

The company was founded in 1959 and is based in Mumbai, India. It has a presence in over 20 states across India.

In the cable TV business, Hathway offers analog and digital cable TV services, with over 230 channels. It has invested heavily in the digitization of its network.

| Company Name | Hathway Cable & Datacom Ltd |

| Market Cap | ₹ 3,383 Cr |

| Debt | ₹ 6.86 Cr |

| P/E Ratio | 56.3 |

| Sector P/E | 46.8 |

| Debt to Equity ratio | 0.00 |

| ROE | 2.15 % |

| Dividend Yield | — |

| 52 Week High/Low | ₹ 22.3 / 12.2 |

| Profit Var 3Yrs | -12.2 % |

| Website | http://www.hathway.com/ |

In broadband, Hathway provides high-speed plans up to 200 Mbps speed using DOCSIS 3.0 technology. It also offers fiber-to-the-home (FTTH) services in some cities.

The company faces competition from players like DEN Networks, Siti Networks, GTPL Hathway, Bharti Airtel, Reliance Jio, etc.

Hathway is currently a subsidiary of Reliance Industries, which acquired a majority stake in 2019. This has provided Hathway access to increased resources and synergies.

Hathway company is owned by the reliance industries. Hathaway stock’s last 3 months’ returns are 14.59% and 6 months’ returns are 40.01% which is good. The company has generated good revenue from the cable TV business.

The company has a strong table TV business and the broadband business from the cable TV business generates 66% of revenue and from the broadband business company generates 34% of the revenue. In the future, the broadband business will expand. Hathway share price target is 2025 the minimum is Rs 23 and the Maximum is Rs 28.

Past five years the company’s revenue has grown yearly by 4.61% and industries negative by 1.07% in the last 5 years, the market share increased from 15.39% to 20.72%. Hathway will increase more market share.

The net income of Hathway company is reducing in financial 2022 the net income is 129.99 crore and in the financial year 2023, the net income is reduced by 49.77% so that is not a good sign for the company. In terms of the company’s healthy growth, the company needs to maintain its balance sheet and increase its net income. Hathway Share Price Target for 2030 the minimum is Rs 40 and the maximum is Rs 50.

If we understand the profit and loss statement of Hathway company then we will find out the operating profit of a company is slow and steady maintained well by Hathway corporation by the company. Hathaway maintains a good OPM of more than 14%.

| By Month | Minimum Price | Maximum Price | Returns |

| January 2040 | ₹65 | ₹66 | 1.89% |

| February 2040 | ₹66 | ₹68 | 1.85% |

| March 2040 | ₹68 | ₹69 | 1.82% |

| April 2040 | ₹69 | ₹70 | 1.79% |

| May 2040 | ₹70 | ₹71 | 1.75% |

| June 2040 | ₹71 | ₹73 | 1.72% |

| July 2040 | ₹73 | ₹74 | 1.69% |

| August 2040 | ₹74 | ₹75 | 1.67% |

| September 2040 | ₹75 | ₹76 | 1.64% |

| October 2040 | ₹76 | ₹78 | 1.61% |

| November 2040 | ₹78 | ₹79 | 1.59% |

| December 2040 | ₹79 | ₹80 | 1.56% |

Hathway company has consistently higher sales in the financial year 2022 the sales of the company were 170.32 crores and in FY 2023 the sales were 1,858 crores Against this the expenses of the company increased due to this the operating profit and net profit were reduced.

The manufacturing cost has increased to 61% against the previous quarter’s previous year 55%. According to the analysis, the Hathway Share Price Target for 2020 the minimum price can reach up to Rs 65 to Rs 80.

Company the promoter holding daily good in 70 5% on the foreign institutional have a holding of 6.69% that is increased by from the previous quarter is 0.09% but the domestic institutional decreased their holding in stock now in September 2023 the holding is by the DII 0.04% and the public holding is 18.27%.

| Share Holder | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Sep 2023 |

|---|---|---|---|---|---|

| Promoters + | 94.09% | 94.09% | 86.61% | 75.00% | 75.00% |

| FIIs + | 2.03% | 2.56% | 3.28% | 6.79% | 6.60% |

| DIIs + | 0.21% | 0.33% | 5.62% | 2.92% | 0.81% |

| Public + | 3.66% | 3.02% | 4.50% | 15.29% | 17.59% |

| No. of Shareholders | 28,453 | 35,179 | 80,797 | 3,07,582 | 3,01,823 |

Hathway Share price target for 2050 the minimum target is Rs 110 and the maximum target is Rs 150.

| Years | Minimum Target | Minimum Target |

| 2025 | Rs 23 | Rs 28 |

| 2030 | Rs 40 | Rs 50 |

| 2040 | Rs 65 Estimated | Rs 80 Estimated |

| 2050 | Rs 110 Estimated | Rs 150 Estimated |

What is the price you think the highway will reach by 2025?

According to their analysis and hour analysis, the stock price of Hathway company could be reached in 2025 around Rs 20 to Rs 40.

Conclusion

You understand the company’s balance sheet can be found that from last 2 years, the company net profit is degrees as we already discussed. However, the compliment in stable sales growth and operating profit maintained well by the company but the net income and net profit is decreased in the financial year 2023.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

Is Hathway cables a good investment?

For long-term investment purposes, the stock P is 56 and the industry P is 46 so it could be considered to be a bit costly.

What is the target price of Hathway 2025?

Hathway share price target is 2025 the minimum is Rs 23 and the Maximum is Rs 28.