Want a personal loan? But due to bad credit, your loan request was rejected here is a comprehensive guide to get a loan with a bad credit score.

We will delve into every point. We will also discuss how you can increase your chance of Laon approval with a bad credit score.

Is the Government providing Free Tablets?

Introduction

If you’re facing unexpected expenses, need funds for a big purchase, or want to consolidate your debts, a personal loan can be a lifesaver, even if your credit score isn’t perfect. We’ll break down the steps to help you secure a loan with bad credit without drowning in financial jargon.

Understanding Credit Scores:

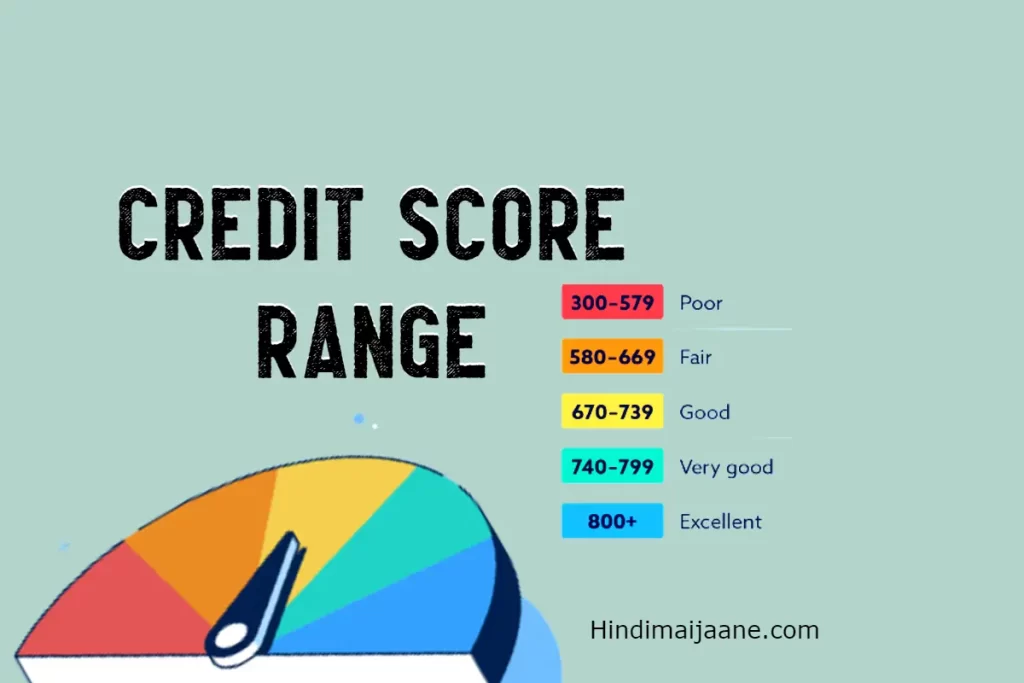

A credit score is a number (300-850) that shows how good you are at managing money. Lenders use it to decide if they should give you a loan or not.

Higher scores are better. It’s based on how you pay debts, use credit, and more. Good scores mean easier loans and lower interest rates. Bad scores make borrowing harder and more costly.

Credit Scores

- Credit scores range from 300 to 850.

- Scores below 670 are considered “bad.”

Don’t worry if you have a low score; it doesn’t mean you can’t get a personal loan.

Check Your Credit Score:

Before taking any loan or applying for a loan always check your credit score.

Checking your credit score before applying for a loan is important it helps you know if you’re likely to get approved. If your score is low, you might face rejection or get higher interest rates, making the loan more expensive.

By checking in advance, you can work on improving your score or find lenders who consider lower scores. It’s like knowing the rules of a game before you play, so you can have a better chance of winning or making the game fairer for yourself.

Request a free credit report from Equifax, Experian, or TransUnion every 12 months.

Identify and correct any errors or old debts dragging down your score.

Define Your Budget

Your budget when taking a personal loan is a plan that shows how you’ll use the loan money while making sure you can still cover your regular expenses. It helps you avoid financial problems and ensures you can repay the loan comfortably.

Don’t take out a loan you can’t afford. If you take a loan with much amount it can lead you to financial problems if you are not able to pay the loan.

Calculate monthly payments and create a repayment plan to fit your budget.

Look Around for Lenders:

Looking around for lenders is a smart move when you need a loan. Different lenders offer different terms and interest rates.

By comparing options from various banks, credit unions, and online lenders, you can find the best deal that suits your needs and financial situation. It’s like shopping for the best price before making a purchase to save money and get the most favorable terms on your loan.

Local banks, credit unions, and online lenders may offer different rates.

Your history with a community bank or credit union can help offset a low credit score.

Some online lenders consider factors beyond your credit score for approval.

Get Prequalified

Getting pre-qualified is an important step when seeking a loan. It’s like getting a sneak peek at what a lender may offer you. During this process, a lender assesses your financial situation without affecting your credit score.

Prequalification helps you make informed decisions and avoid potential surprises when applying for a loan, ensuring a smoother borrowing experience.

It involves a soft credit check and can help you avoid further credit damage.

Consider Secured Loans:

Secured loans use personal assets like your home or car as collateral.

While they typically come with lower interest rates, it’s crucial to be confident in your ability to make payments, as the lender can take your collateral if you default. Secured loans offer a way for individuals with less-than-perfect credit to access funds at a more affordable cost, but they also come with the responsibility of safeguarding your assets

They often have better rates but carry the risk of losing your property if you can’t repay.

Gather Financial Documents:

Applying for a loan requires documents like your identification, tax returns, bank statements, pay stubs, and bills.

- Personal Identification: A government-issued photo ID.

- Proof of Income: Pay stubs, income statements, or tax returns.

- Employment Verification: Employment letter or employer contact information.

- Bank Statements: Statements for checking and savings accounts.

- Credit History Information: Credit report or explanation of negative events.

- Debt Information: List of existing debts and loan statements.

- Proof of Address: Utility bills, rental agreements, or mortgage statements.

Keep in mind that lenders may have different documentation requirements, so it’s essential to inquire with the lender you plan to work with to understand their specific needs for the type of loan you are seeking.

Points to remember before taking a Loan with a Bad Credit Score

Before getting a loan with bad credit, there are several important factors to consider to make informed decisions and avoid potential pitfalls:

- Interest Rates: Expect higher interest rates with bad credit; understand how they impact the total loan cost.

- Loan Terms: Review repayment periods; longer terms may have lower monthly payments but higher overall costs.

- Budget: Ensure loan payments fit comfortably within your budget to avoid financial strain.

- Lender Reputation: Choose a reputable lender to avoid scams and predatory practices.

- Fees and Penalties: Be aware of additional fees and penalties associated with the loan.

- Impact on Credit: Recognize that timely payments can improve your credit, while missed payments worsen it.

Where to Find Loans with Bad Credit:

With a bad credit score, you can get a loan with an online lender or credit union.

| Best Places to Look for Loans |

| Online lenders |

| Banks |

| Credit unions |

Disadvantages of Taking a Loan With Bad Credit

Taking a loan can be good if you can repay and if you need urgent money for your personal use.

Certainly, here are the disadvantages of taking a loan with a bad credit score presented in points:

Higher Interest Rates: Borrowers with bad credit typically face significantly higher interest rates, resulting in increased overall loan costs.

Limited Loan Options: You may have fewer loan options available, and those that are offered may come with unfavorable terms and conditions.

Stricter Approval Requirements: Lenders may require more extensive documentation and stricter approval criteria, making it harder to qualify.

Smaller Loan Amounts: The approved loan amount may be smaller than what you need, limiting your ability to cover substantial expenses.

Shorter Repayment Terms: Loans for bad credit often come with shorter repayment periods, resulting in higher monthly payments.

Impact on Credit Score: If you struggle to make payments on time, it can further damage your credit score, making it even harder to secure credit in the future.

Financial Stress: High monthly payments and increased loan costs can lead to financial stress and strain on your budget. Which can also cause stress on you.

Difficulty in Future Financing: A history of bad credit loans can hinder your ability to secure favorable loans, mortgages, or credit cards in the future.

It’s important to carefully consider these disadvantages and explore all options before taking a loan with a bad credit score. Additionally, working on improving your credit can lead to better loan terms and financial opportunities down the road.

Conclusion:

Getting a loan with bad credit may seem challenging, but it’s possible. By following these straightforward steps and staying informed, you can secure the funds you need without falling into financial traps.

Is there any way to get a loan with really bad credit?

Some lenders can offer you a personal loan with a bad credit score.

Can I get a loan with a 500 credit score?

Lenders could approve applicants with credit scores as low as 500, however, they may have additional requirements, such as minimum income or employment history. Check out the costs and interest rates.

Which loan is easiest to get with bad credit?

Bad credit applicants can normally qualify for secured loans more easily, and they typically have better interest rates than other options.

What credit score do I need for a $5000 loan?

Each lender has their own requirements for a $5,000 loan. But generally speaking, you should have credit that is not below 580 of credit score. During the application procedure, lenders may also take into account additional elements, such as your income and debt-to-income ratio (DTI).

What is the lowest credit score you can get a loan with?

Your history of paying bills on time is the most important factor in your credit score. They also look at how much money you owe. Usually, you need a credit score of around 610 to 640 just to be considered for a personal loan.

What disqualifies you from getting a personal loan?

If you do not meet the parameters of the lender you may disqualify from getting a personal loan.

What is the minimum income for a personal loan?

The minimum income required for a personal loan depends on the lender and can range from $10,500 to over $100,000. Some lenders, like LendingPoint, require a minimum annual income of $35,000. Others, like Citizens Bank, require a minimum annual income of $24,000.

Can I get a loan if my income is low?

It doesn’t mean that if you have a low income cannot get a loan. If your income is stable and enough to repay the loan and you qualify for lender criteria you can get the loan.

What makes me eligible for a personal loan?

If you meet the lender criteria and have a minimum credit score a lender can provide you loan. Having a stable income source you can get a loan from the lender.