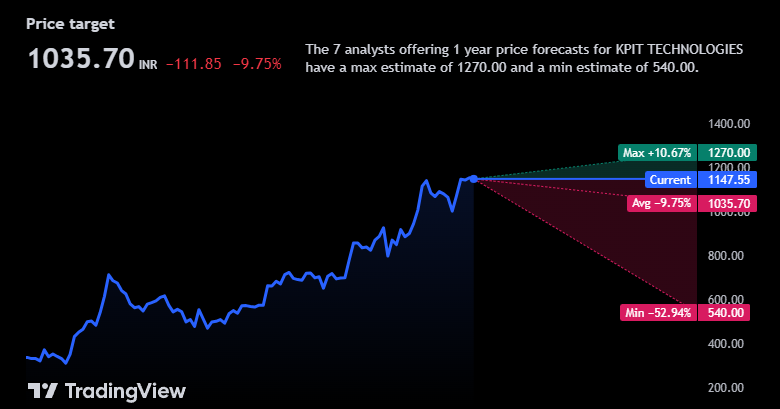

Kpit share price target for 2025 is a Minimum of Rs 1035 and a Maximum of Rs 1360.

Hello Investors, In this article, we are going to discuss the KPIT Share Price Target for 2025-2030-2040-2050. Through this article, we are going to understand the company’s financial component and how the company is growing to perform in the future.

Kpit is an IT sector company. There is a global technology company with a software solution that can help mobility live frogs towards an autonomous clean smart and concentrated future.

KPIT Company Overview

| Company Name | KPIT Technologies Ltd |

| Market Cap | ₹ 31,459 Cr. |

| P/E | 72.9 |

| Sector P/E | 35.3 |

| Debt to Equity ratio | 0.17 |

| ROE | 25.7 % |

| DEBT | ₹ 287 Cr. |

| Return over 3years | 132 % |

| Dividend Yield | 0.36 % |

| 52 Week High/Low | ₹ 1,202 / 522 |

| Website | http://www.kpit.com/ |

KPIT is a leading independent software development and integration partner serving the automotive and mobility industry. Founded in 1990 and headquartered in Pune, India, KPIT specializes in providing solutions built on emerging digital technologies to help its clients transform and evolve their software systems and business models.

KPIT partners with vehicle manufacturers, component suppliers, fleet operators, and new-age mobility companies across the globe to co-innovate software-defined vehicles and software-driven mobility solutions.

Key solutions offered include vehicle electronics and software, autonomous technologies, connected solutions, cybersecurity solutions, powertrain and e-mobility, AI, and digital solutions.

With 8500+ experts spread across Europe, North America, Asia Pacific, and Japan, KPIT brings deep software, domain, and localization capabilities. Through experience design studios, innovation labs, and centers of excellence it delivers next-gen technologies and accelerated product development.

KPIT works with leaders such as BMW, Daimler, Renault-Nissan, Volkswagen, Volvo, and Marelli across the vehicle development spectrum right from the concept stage to SOP to manage complete software stacks. It also partners with new players focusing on connected, autonomous, and shared mobility.

Over the last decade, KPIT has strengthened its capabilities in new age mobility tech including over-the-air updates, autonomous driving platforms, battery management systems, and vehicle network architecture which will be crucial technology building blocks for the future of the industry.

With innovative business models, strong client partnerships, extensive tech expertise, and a collaborative ecosystem – KPIT is gearing up intelligently to consolidate its position further as a leader in the software-driven mobility landscape.

Stock’s past 3-month returns are 16.87% and 1-year returns are 99.91%. The stock is very good. If we expected the same returns next year. According to Tradingview analysts 9 has a rating of hold. Today revenue of this quarter has increased by 59.42% Year on year and the net profit for this quarter is 56.85% year on year. Total revenue in June quarter 2023 was Rs 1,119.13 Crores against March 2023 1024.14 Crores. Kpit share price target for 2025 is a Minimum of Rs 1035 and a Maximum of Rs 1360.

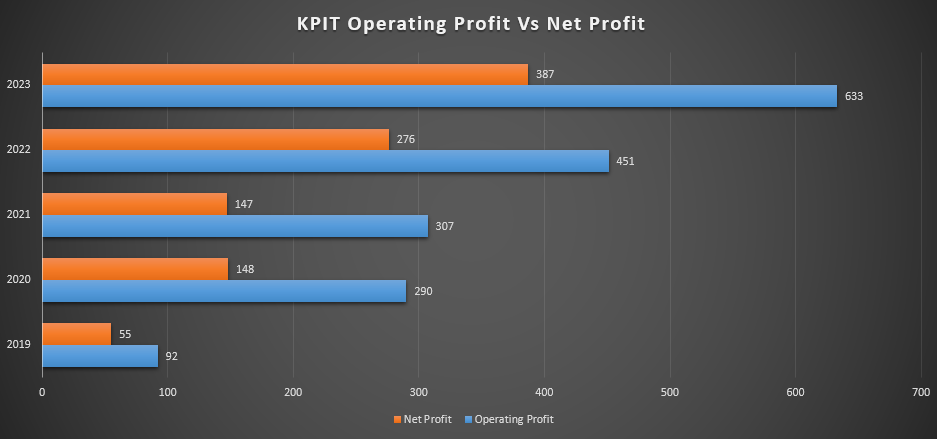

When we see the KPIT tech return is absolutely really good, the past 2-year return is 274%. It may be the company giving a 100% return in a year. KPIT Quarterly result June 2023 sales of Rs 1,098 and operating profit is ₹214 Crores. Previous Quarter Results were Operating Profit was ₹182 Crores. KPIT Share Price Target ₹3000.

The company operates internationally company most of the revenue comes from outside the company 39% of the revenue comes from the USA 40% from Europe and 21% comes rest of the world. This is a good thing that the company operates internationally so the company would not depend on any particular country. KPIT Share Price Target for 2040 could be reached to ₹5000.

The company also made some acquisitions like Path Partner Technology Private Limited in the future mobility solution. The good thing is that the majority of acquisitions the company made in the last quarter of 2023. So the impact of the acquisition will come in the upcoming time. KPIT Share Price Target for 2050 estimated is at Rs 8000 rupees.

- Yes Bank Share Price Target in 2025

- Alstone Textiles Share Price Target 2025

- RVNL Share Price Target 2030

- Khoobsurat Share Price Target 2025

- Urja Global Share Price Target in 2030

| Years | Target |

| 2025 | Rs 1360 |

| 2030 | Rs 3000 Estimated |

| 2040 | Rs 5000 Approx |

| 2050 | Rs 8000 Approx |

KPIT Strengths and Weaknesses

Strength

- The company expected to give a good quarterly result

- Company compound and Sail growth in the past 3 years is 46%, component profit in the past 3 years is 36% and the return on equity is 21%.

Weaknesses

- Promoter holding has decreased over the past 3 years is minus 3.15%.

- The Stock P/E ratio is high at 68.0

According to the trading website, 8 analysts give the rating to KPIT Technology for as a buy 2 as a hold, and 2 as a strong sell.

According to the MSN website, 10 analysts give their rating to hold and their 12-month target is Rs 987.80.

Conclusion

Overall the company financials are really strong and the return on equity is also a really good year is 21% and in the past 5 years 19%. And if you see the company’s product the company product is futuristic like companies working on AI and making IOT-based models.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

FAQ

Is KPIT a good stock?

Yes, the companies financially are strong and the stock returns are also really good. The last 2-year return is 274.74%.

What will be the share price target of KPIT in 2025?

Kpit share price target for 2025 is a Minimum of Rs 1035 and a Maximum of Rs 1360.

Is KPIT a tech debt-free company?

Yes, The company is in debt of 283 crores.