Kshitij Polyline Share Price Target for 2025 minimum is Rs 18 and the Maximum is Rs 25.

Kshitij Polyline company is engaged in the manufacturing, marketing, and distribution of lamination equipment and stationery products. Its products include polypropylene sheets and rolls, binding materials, ID card accessories, lamination materials, and plastic files and folders. The company was founded in 1998 and is headquartered in Mumbai, India.

Yes, this is also one penny stock with a price of 7.60 today this Friday the stock has increased by 4.83% per upper circuit. Are you looking for a better buying price or looking for an investment? This article will help you with your investment.

Jio Financial Share Price Target 2025

This article will guide you through investment in a prestigious Kshitij Polyline company. What is a company’s product? what the company is doing and what the future price of the following company is.

Key Points

- Promoter holding has decreased over the last 3 years: -6.17%

- High-Risk Stock

- The company has a debt of ₹ 17.27 Cr.

Kshitij Polyline Company Overview

We will do a fundamental analysis of the Kshitij Polyline company we will see the P/E ratio sector P/E and what are the sector growth and company growth.

| Company Name | Kshitij Polyline Ltd |

| Market Cap | ₹ 38.50 Cr |

| Number of Shares | 5.07 Cr |

| P/E | 84.82 |

| Sector P/E | 14.52 |

| 52 Week High/Low | ₹ 70.80/₹ 5.55 |

| Debt | ₹ 17.27 Cr |

| ROE | 2.28 % |

| Sales Growth | 60.98% |

| Official Website | https://www.kshitijpolyline.com/ |

Kshitij Polyline Company has the following product

- Winding material

- Lamination material

- OHP sheets

- Cardholder

- Metal clip fitting and accessories

- Personalized product

- Plastic file and folder

- Industrial plastic sheet smart ID card product

- Sanitizer stand-watch film extra

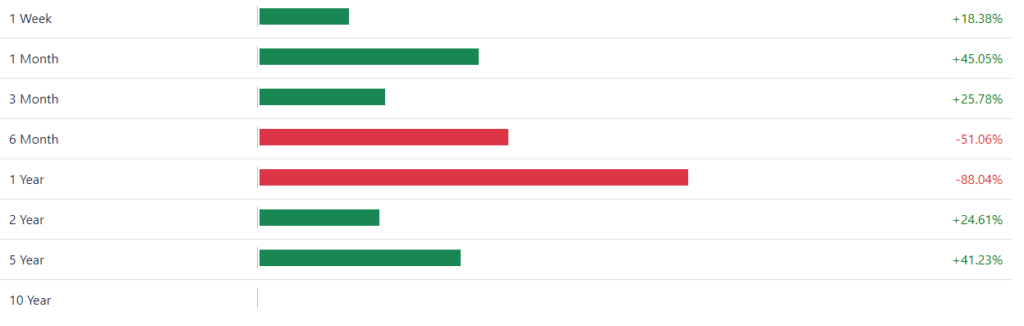

if you see the Kshitij Polyline line Stock chart then you will understand that the stock most of the time Moves in the Upper circuit and lower circuit but when starts hitting the upper circuit. this will give a us good return now again the stock has started moving in the upper circuit. Stock’s previous 1-month returns are +45.05% and the last 3 months’ returns are +25.78%.

Kshitij Polyline Share Price Target for 2025 minimum is Rs 18 and the Maximum is Rs 25.

The company has diversified business all over the world. Company Exports in Uganda, Lebanon, Sri – Lanka, South Africa, Bhutan, Nepal, USA, Dubai, Canada, Indonesia, etc

Kshitij Polyline Share Price Target for 2030 minimum is Rs 28 and the Maximum is Rs 40.

The company has entered into an e-commerce page to develop its stationery brand product and sell products through all the possible mod like developing websites selling other E-Commerce platforms and opening a store.

The company is also adding new products.

Kshitij Polyline Share Price Target for 2030 minimum is Rs 50 and the Maximum is Rs 60.

you see the company compounding says growth that is not worst in fast 3 years that is 2% in fast five years that is 5% but profit growth is Negative.

the return on the equity you can say is less than a decent part 3 reason 2% and fast five years is 3% and last year is 2%.

Kshitij Polyline Share Price Target for 2030 minimum is Rs 70 and the Maximum is Rs 95.

| Years | Minimum Target | Minimum Target |

| 2025 | Rs 18 | Rs 25 |

| 2030 | Rs 28 | Rs 40 |

| 2040 | Rs 50 Estimated | Rs 60 Estimated |

| 2050 | Rs 70 Estimated | Rs 95 Estimated |

Personal Opinion

Personal opinion: the stock overall runs upper circuit and lower circuit most of the time the stock runs in a circuit so difficult to get entry. You can invest a little bit of money but not much at this time if you get an entry this could be a perfect time for you to make a profit.

Pro and Kshitij Polyline Company

Pros

- The company has an international business market

- If you get increased at the right time get a good return.

Weaknesses

- Promoter reduce their holding

- The foreign institutional investor also reduces their holding

Conclusion

please quarterly result then in March 2023 company has a net profit of 2.9 CR and the sales have increased from the past year. SB discussed already the company comes in an e-commerce website for selling its products from this side maybe the company’s sales and revenue both will increase in the upcoming time. But still, this is a penis stock and high risk.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

Is Kshitij Polyline a good buy?

Kshitij Polyline is a Risky investment because the stock is mostly moved in the Upper Circuit and Lower Circuit.

How many shares are there in Kshitij Polyline?

Kshitij Polyline’s number of Shares is 5.07 Cr.

What is the target of Kshitij Polyline’s share in 2023?

Kshitij Polyline Share price target in 2023 is Rs 10.