The power sector is undergoing a dramatic transformation, and the renewable energy sector is leading the charge. As a result, companies like Orient Green Power are experiencing significant growth and investor interest.

This article explores Orient Green Power’s business model, analyzes key factors influencing its share price, and provides insights into its future potential.

Orient Green Power Company deals in power generation through wind Energy. Company 92% of revenues came from India. Orient Green Power Company is an Independent Producer of Renewable Power, the company is engaged in developing, owning, and operating a diversified portfolio of Wind Energy Power Plants.

This article will analyze Orient company. Orient green power stock price Target based on stock price returns and company financial condition. We will also see the Analyst Rating on Orient Green power stock.

Orient Green Power Company Overview

Orient Green Power Company Limited (OGP) is a leading Indian independent renewable energy producer. As of June 2022, it boasts a diverse portfolio with:

- 402.3 MW of wind power assets across Tamil Nadu, Andhra Pradesh, Gujarat, Karnataka, and Croatia (Europe).

- 106 MW of biomass power plants utilizing agricultural residues and waste in Tamil Nadu, Maharashtra, Rajasthan, Telangana, and Madhya Pradesh.

| Company Name | Orient Green Power Company Ltd |

| Market Cap | ₹ 1,137.35 Cr. |

| P/E | 54.9 |

| Sector P/E | 27.4 |

| Debt to Equity ratio | 2.08 |

| ROE | 1.82% |

| DEBT | ₹ 1,091 Cr. |

| Return over 3years | 93.2 % |

| Dividend Yield | 0.00 % |

| 52 Week High/Low | ₹ 16.8 / 7.70 |

| Website | http://www.orientgreenpower.com/ |

Orient Green Focuses

- Developing and operating renewable energy projects: Wind energy dominates, with plans to expand to over 1,000 MW. Biomass power utilizes agricultural waste for environmentally friendly electricity generation.

- Selling electricity: OGP supplies power to state grids under long-term power purchase agreements, ensuring stable revenue streams.

- Generating carbon credits: OGP projects earn carbon credits from international bodies, contributing to global climate change mitigation efforts.

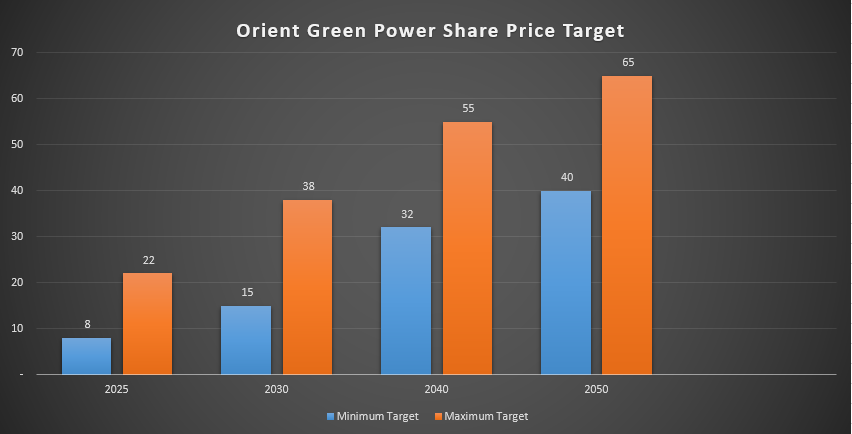

Orient Green Power stock’s past 1 year returns are 52.13%. which is considered good returns. Jun Quarter revenue growth is +49.53% Orient Green published Good results. If the Company continuously improves its balance sheet then Orient Green Share price minimum Target is Rs 8 and maximum is Rs 22.

Orient Green’s Net income increased in the Quarter by +141.76%. stock’s past 3 years’ returns are 565.12%. If the stock gives the same in the future then Orient Green’s Share price target in 2030 minimum is Rs 15 and maximum Rs 38.

Orient Green stock list in NSE on 11th Oct 2010 with Rs 45.12. after stock continuously falls due to bad sales and balance sheets. But in the past few years, the Company has improved its balance. Orient Green’s past 10 years’ returns are 19.68%. Orient Green’s Share price target in 2040 minimum is Rs 32 and the maximum is Rs 55.

Promoter holding continuously decreased and Foreign institutional investors also reduced their holding. This is not a good sign for the company.

Past 3 years, sales growth is -11%, and profit growth is -20%. Orient Green’s Share price target in 2050 minimum is Rs 40 and the maximum is Rs 65.

| Years | Minimum Target | Maximum Target |

| 2025 | Rs 8 | Rs 22 |

| 2030 | Rs 15 estimated | Rs 38 estimated |

| 2040 | Rs 32 Approx | Rs 55 Approx |

| 2050 | Rs 40 Appox | Rs 65 Approx |

Orient Green Power Stock Chart

- LIC Share Price Target 2025 to 2050

- Yes Bank Share Price Target in 2025

- Alstone Textiles Share Price Target 2025

- RVNL Share Price Target 2030

- Khoobsurat Share Price Target 2025

- Urja Global Share Price Target in 2030

- ITC Share Price Target 2025

- South Indian Bank Share Price Target 2025

- KPIT Tech Share Price Target 2025

- NCL Research Share Price Target 2025

The factors that affect Orient Green’s share price include:

- The company’s financial performance

- The overall performance of the Indian stock market

- The global economic environment

- Government policies

- Competition from other companies in the sector

Orient Green Strength and Weakness

Strength

- The company delivered a good quarterly result.

- Stock cage year is 90% past 3 years.

- The company has a good amount of free cash flow of 227.06 crore

- Companies showing good signs of profitability and efficiency.

Weaknesses

- Total revenue for this quarter decreased by 3.6% Year on Year 3.6%.

- Net profit for this cottage decreased by 4.97% year on year

Conclusion

The stock financially is not strong but the stock gives a good return in the 3-year stock gives 607.14% returns. According to the money control and laces desk, 12 investors have their views and 100% are bullish on a stock.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

Frequently Ask Question(FAQ)

Is Orient Green Power Stock a good buy?

Stock financially is not a release table but the stock gives a good return for their investors. This is a penis talk and high risk related to the stock.

What is the share price target of Orient Green in 2025?

Orient green share price target in 2025 is between a minimum is ₹8 and a maximum is ₹22.

What is the share price target of Orient Green in 2030?

Orient green share price target in 2030 is between the minimum age of 15 and the maximum is Rs 38.

Is Orient a green or debt-free company?

No, Orient Green has a debt of 1,091 crore.