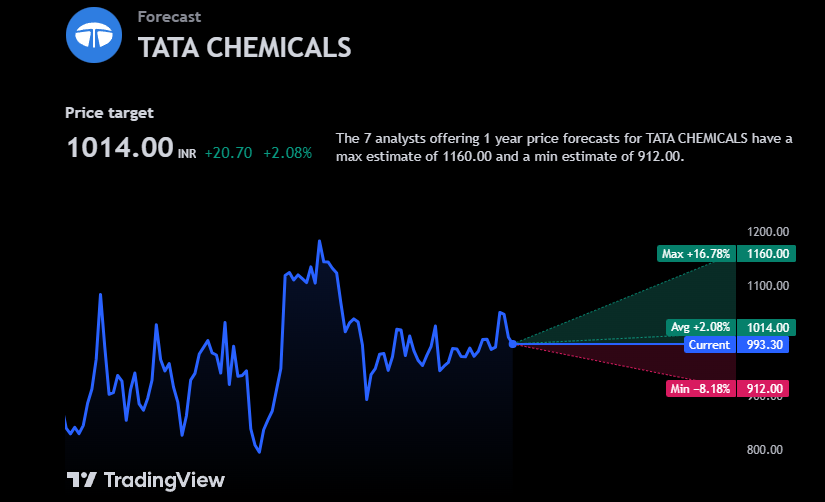

TATA Chemicals Share Price Target in 2025 minimum is Rs 912 and the maximum is Rs 1160.

Tata Chemicals is a part of Tata Group which is a global leading company manufacturer in 3rd soda Ash and 6th sodium bicarbonate.

In this article, we are going to analyze Tata Chemical’s share price target. Based on the stock return and the company financials we are going to predict the share price target for 2025-2030-2040 and 2050. We will also share the brokerage reports and brokerage targets for easy understanding.

Tata Chemicals Stock Rating by Analysts

According to the Trading View website forecast 7 analyst has their reviews to have a strong with 3 has a hold call and 2 sell.

Tata Chemicals Stock Target by the Brokers

| Brokerage Name | Update Date | Target |

| Geofin Comtrade | 06 Mar 2023 | Rs 1197 |

| ICICIdirect.com | 03 Feb 2023 | Rs 1170 |

| Motilal Oswal | 28 Oct 2022 | Rs 1250 |

| ICICIdirect.com | 29 Oct 2022 | Rs 1345 |

Tata Chemicals Company Overview

| Company Name | Tata Chemicals Ltd |

| Market Cap | ₹ 25,085.85 Cr |

| P/E | 25.76 |

| Sector P/E | 11.11 |

| Debt to Equity ratio | 0.32 |

| ROE | 12.0 % |

| DEBT | ₹ 6,296 Cr |

| Return over 3years | 49.6 % |

| Dividend Yield | 1.75 % |

| 52 Week High/Low | ₹ 1,215 / 877 |

| Website | http://www.tatachemicals.com/ |

The stock’s 1-year return is not really good and according to the market expert Tata Chemicals share price target in 2025 minimum is Rs 912 and the maximum is Rs 1160.

Tata Chemicals Company sales growth at a fast 3-year compounding growth is 17% and compounding profit in the past 3 years is -31% but the stock CAGR in part 3 year is really good 50%.

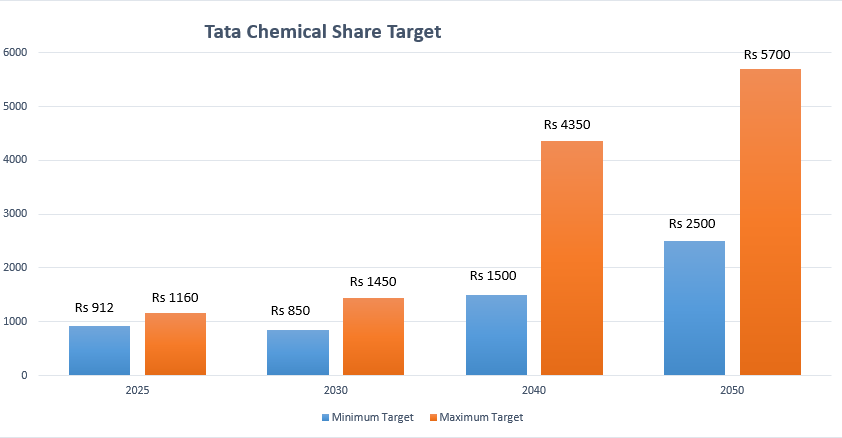

On a Daily frame, the Tata Chemicals stock is currently trading near 200 EMA. Last 333 days, the stock corrected 18.06%. Tata Chemicals share price target for 2030 minimum is Rs 850 and the Maximum is Rs 1450.

Stopping the past year’s revenue growth average is 14 points 40% and the industry average growth is 15 points 34% means Company needs to increase the revenue.

But the company’s net income is higher than the industry average income in the past 5 years 166.40% and the industry average income is 25.9%. Tata Chemicals share price 2040 minimum is Rs 1500 and the maximum is Rs 4,350.

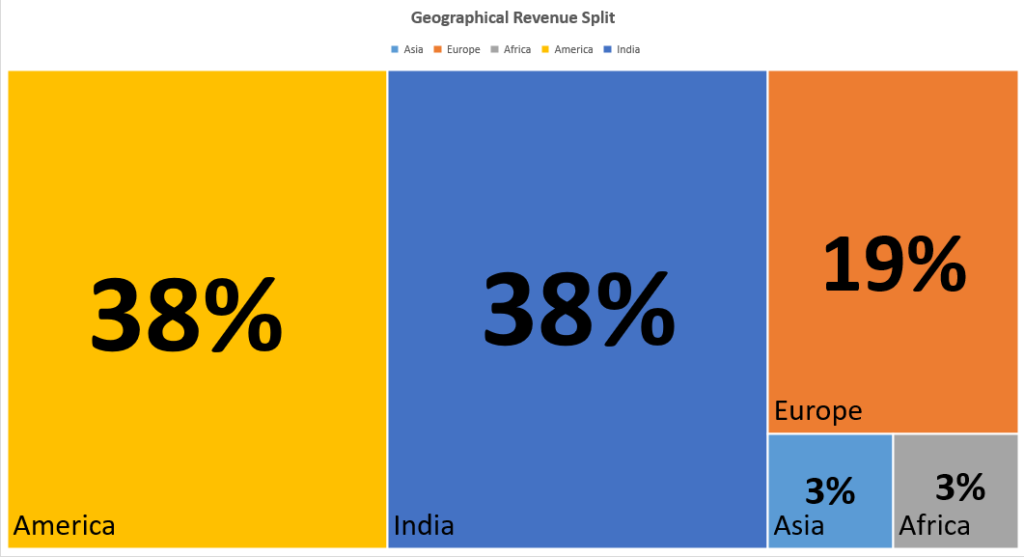

According to the financial 2022 data basic chemistry product revenues are 77% special product revenues 23% geographical revenue split of Tata chemical company 3% from Asia 19% from Europe 3% from Africa 38% from America and 38% from India.

The company’s selling product is soda Ash which generates 52% of its revenue.

Tata Chemicals share price target in 2050 minimum is Rs 2500 and the maximum is Rs 5700.

| Years | Minimum Target | Maximum Target |

| 2025 | Rs 912 | Rs 1160 |

| 2030 | Rs 850 estimated | Rs 1450 estimated |

| 2040 | Rs 1500 Approx | Rs 4350 Approx |

| 2050 | Rs 2500 Approx | Rs 5700 Approx |

- LIC Share Price Target 2025 to 2050

- Yes Bank Share Price Target in 2025

- Alstone Textiles Share Price Target 2025

- RVNL Share Price Target 2030

- Khoobsurat Share Price Target 2025

- Urja Global Share Price Target in 2030

- ITC Share Price Target 2025

- South Indian Bank Share Price Target 2025

- KPIT Tech Share Price Target 2025

- NCL Research Share Price Target 2025

Tata Steel Financial

| Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | |

| Share Capital + | 255 | 255 | 255 | 255 | 255 | 255 | 255 |

| Reserves | 7,653 | 10,847 | 12,086 | 12,643 | 14,035 | 17,998 | 19,466 |

| Borrowings + | 7,072 | 6,108 | 6,130 | 7,702 | 6,933 | 7,024 | 6,296 |

| Other Liabilities + | 8,607 | 8,648 | 8,398 | 7,073 | 7,115 | 8,566 | 8,923 |

| Total Liabilities | 23,587 | 25,858 | 26,869 | 27,673 | 28,337 | 33,843 | 34,940 |

| Fixed Assets + | 12,644 | 12,787 | 13,551 | 15,356 | 15,261 | 16,044 | 17,092 |

| CWIP | 333 | 409 | 774 | 835 | 1,094 | 1,668 | 2,410 |

| Investments | 2,787 | 2,840 | 5,615 | 4,285 | 5,816 | 7,683 | 7,448 |

| Other Assets + | 7,822 | 9,822 | 6,929 | 7,198 | 6,167 | 8,448 | 7,990 |

| Total Assets | 23,587 | 25,858 | 26,869 | 27,673 | 28,337 | 33,843 | 34,940 |

Tata Chemical stock strength and weaknesses.

Strength

- The company is virtually debt free.

- The company showed good revenue growth of 19.07% in the past 3 years.

- Domestic institutions increase their folding by 0.14%.

Weaknesses

- Stock returns have been really low in the past 1 year.

- Company profit growth of negative 46.85% for the past 3 years.

- FII decreased their holding by 0.12%.

Conclusion

Tata Chemical is a financially stable company for the operation efficiency is really poor in the case of asset management. Stock is really stable in a company’s market cap is 25,325.32 Crores.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

Is Tata Chemical a good share to buy?

According to the analysis, the one-year target for Tata Chemical is Rs 1160.

Is data chemical a debt-free company?

Tata Chemical is a debt of 6,296 crore.

Ise Tata chemical in battery manufacturing?

Tata Chemical signed a MoU with the Gujarat government to set up a lithium-ion cell manufacturing plant for 13,000 crore.

What is the share price of Tata Chemical in 2025?

Tata Chemicals’ share price target in 2025 minimum is 912 Maximum is 1160.

What is the share price of Tata Chemical in 2030?

Tata Chemicals’ share price in 2030 maximum is Rs 850 maximum is Rs 1450.