Yes Bank faced the worst time in the banking sector. However Yes Bank survived. The government of India helped to recover the bank from losses. Now Yes Bank is growing.

In this article, we will look into Yes Bank’s business and growth. We will forecast the share price of Yes Bank.

We’ll examine the reasons behind the recent decline in the stock’s value, assess its potential for recovery, and uncover insights from seasoned investors to forecast its future direction.

Analysts predict that Yes Bank’s share price could range from a minimum of Rs 14 to a maximum of Rs 19 in 2023. These projections are based on various factors, including the company’s financial performance, market conditions, and overall economic outlook.

To grasp the prospects of Yes Bank, it’s crucial to understand its financial situation. We’ll scrutinize the company’s financial statements, examining its revenue, profitability, and debt levels.

This analysis will provide valuable insights into the company’s financial health and its ability to withstand market fluctuations.

Yes Bank Company Overview

Yes Bank is India’s 4th private largest bank. The bank was founded in 2004 by Ashok Kapoor. The bank is headquartered in Mumbai, India.

Yes Bank provides a range of banking services including corporate and retail banking, business loans, trade finance, treasury operations, and wealth management.

Yes Bank has more than a network of 1150 branches across India and more than 1000 ATMs across India. With a total assets of around ₹2.4 lakh crore.

The bank has a particular focus on lending to small and medium-sized enterprises (SMEs). It also lends to India’s growing middle-class segment.

The Yes Bank Tragedy: The company growth was good before 2020. However in 2020 Yes Bank faced challenges.

In March 2020, Yes Bank faced a crisis and had to be bailed out through a reconstruction scheme backed by the Reserve Bank of India and the Indian government. Its financial health has since improved after the bailout.

| Company Name | Yes Bank Ltd |

| Market Cap | ₹ 49,316.33 Cr. |

| P/E Ratio | 65.81 |

| Sector P/E Ratio | 24.66 |

| Debt | ₹ 2,95,136 Cr |

| Cash | — |

| ROE | 1.95 % |

| 52- Week High/Low | ₹ 24.75/₹ 14.40 |

| NO. OF SHARES | 2,875.59 Cr |

| Website | https://www.yesbank.in/ |

In FY22, the bank reported a net profit of ₹1,066 crore, compared to a loss of ₹3,462 crore in FY21. Its loan book grew by around 10% in FY22.

Yes, Bank shares gave a 29.96% return in the past 1 year. Yes Bank has a pan-India presence with branches in over 2,000 cities and towns. The bank also has a presence in international markets through its representative office in Abu Dhabi.

The NPA of Yes Bank declined from 2021 which is a good sign for the growth of share price. The bank holds major payments of UPI transactions.

Readers also Like to Read

- Axis Bank Share Price Target 2025

- Tata Power Share Price Target 2030

- Adani Power Share Price Target 2025

- Urja Global Share Price Target 2030

According to the money control website, 87% of reviews are on by Yes Bank share price. Yes after the massive falling share price of the year when the company is maintaining its balance sheet.

Yes, the Bank launching its new product to the customer and Inhen Singh is their customer experience for the retailers they individually launched the IAS robot WhatsApp supports Pay Iris which is for the mobile platform, and digital rupees are the online services that are provided by the bank for the retail customers. Its Yes Bank share price for 2023 minimum is Rs 14 and the maximum is ₹19.

| Minimum Target | Maximum Target | Average price Year |

| Rs 14 | Rs 19 | Rs 16.5 |

Yes, the Bank’s past 3-month return is 9.24% and the past 1-year return is 12.46% which is a really nice return from a stock.

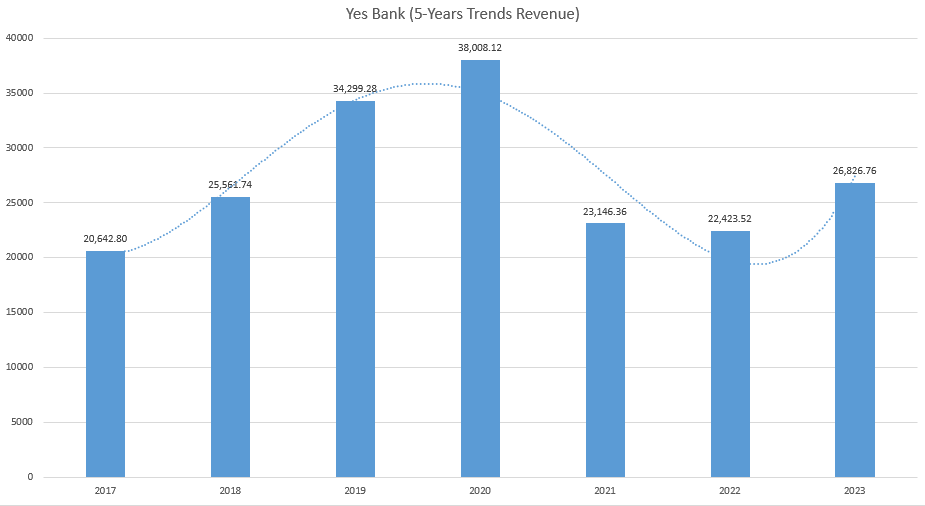

Yes Bank company revenue increased by 19.6 3%. The revenue in the last year was ₹22,423.52 crores and in March 2023 it was 26,826.76 crores. Yes bank share price target for 2025 minimum is Rs 30 and the maximum is Rs 50.

| Minimum Target | Maximum Target | Average price Year |

| Rs 22 | Rs 30 | Rs 26 |

In January 2023 the company launched a new car that is fully customizable according to the customer experience in that the company gives study group leading 20% of the year-on-year growth in customer base that helped the company reach 1.5 million user base and the highest ever new position is 64000+ card and spend of 1715 crore in March 2023.

| Minimum Target | Maximum Target | Average price Year |

| Rs 110 | Rs 125 | Rs 118 |

Yes, the Bank share price target in 2030 is if a company gives a return as the stock given in the past 1 year in the stock price would be ₹ 125.

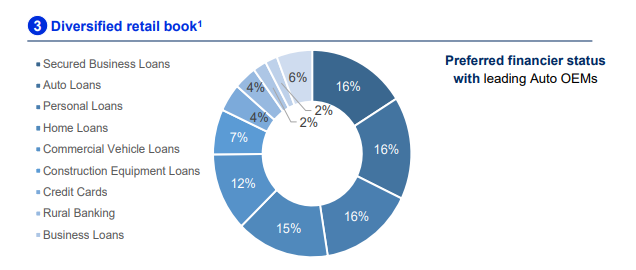

The bank has a retail book for financial 2025 percent auto alone is 18% numerology 23% and commercial loans 23%.

The company generates a 67% interest discount on advance bills income on investment including 13% interest on balance with the reserve Bank of India and another bank 43% other is 2% other income is 15% segmental revenue financial 26% corporate and wholesale wanging in 39% retail banking in 33% and other bank operations 2%.

The Yes Bank share price target for 2040 is between ₹200 to ₹250

| Minimum Target | Maximum Target | Average price Year |

| Rs 200 | Rs 250 | Rs 225 |

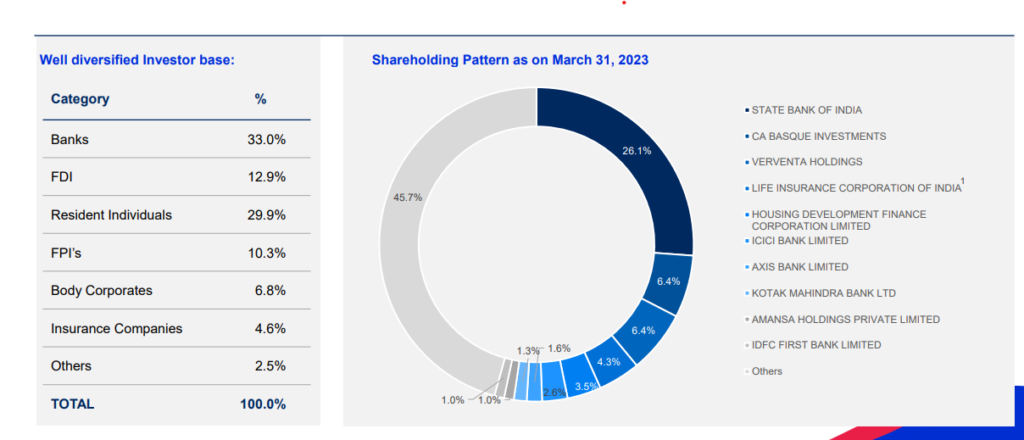

Promoter holding is zero in Yes Bank but a good sign is that it invested 60.87%. company net profit in March 2023 is 981 CR which is now the company is more stabling itself after the share crash.

Companies’ total revenue increasing year by year by 25%. If that company increases its revenue and manages a good balance sheet then the share price target of 2050 would be ₹ 900 to Rs 1000.

| Years | Minimum Target | Minimum Target |

| 2023 | Rs 14 | Rs 19 |

| 2025 | Rs 30 | Rs 50 |

| 2030 | Rs 110 | Rs 125 |

| 2040 | Rs 200 Estimated | Rs 250 Estimated |

| 2050 | Rs 900 Estimated | Rs 1000 Estimated |

Yes Bank’s strengths and weaknesses

Strength

- Yes bank has a good capital Adequacy ratio of 17.90

- The company has delivered a good profit growth of 26.90% over the past 3 years.

Weaknesses

- The company has a very low track record

- The high cost-to-income ratio of 73.13%

Conclusion

In the summary, we have discussed the business of Yes Bank. We shared analysis and predicted the share price of Yes Bank for 2025,2030,2040 and 2050.

You can share your thoughts in the comment section we will be very happy to see your thoughts.

Disclaimer

Any target mentioned on this website is taken by our analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

What is the 52-week high/low of Yes Bank’s share price?

Yes Bank’s share price is Rs. 25.30 and the 52-week low is Rs. 7.85.

Who owns Yes Bank?

26.14 stock owned by SBI bank in Yes Bank.

What is the future of Yes Bank’s share price?

The future of Yes Bank’s share price is uncertain. However, if the bank’s financial performance improves and investor sentiment improves, the share price could rise.

Is Yes Bank overvalued stock?

No, the Stock is undervalued yes bank’s intrinsic value is 24.89 INR.

Can I buy more than 100 shares of Yes Bank?

It’s dependent upon your risk management.

What is Yes Bank’s Share Price Target for 2025?

Yes bank share price target for 2025 minimum is Rs 30 and the maximum is Rs 50.

References: Money Control