Are you curious about the future of Bank of Maharashtra’s share price? In the world of finance, predicting the trajectory of a stock can be as challenging as forecasting the weather.

We will understand financial projections to uncover the potential share price targets for the Bank of Maharashtra in the years 2025, 2030, 2040, and 2050.

Whether you’re an investor seeking insight or simply intrigued by the mysteries of stock market fortune-telling, this article is your guide to the future of this venerable bank’s stock.

IOB Share Price Target 2025-2030-2040-2050

Bank of Maharashtra comes in the 12th place in terms of market cap.

Amazing Facts about Bank Of Maharashtra

- Bank of Maharashtra is the first bank in India to introduce a special loan scheme for women entrepreneurs. The scheme was launched in 1982 and was called the “Mahila Udyam Nidhi Yojana.” It was designed to provide financial assistance to women entrepreneurs to set up and run their own businesses.

- Bank of Maharashtra is the first bank in India to introduce a mobile banking app in Marathi. The app, called “BOM Mobile Marathi,” was launched in 2012 and allows users to perform various banking transactions in Marathi, the official language of Maharashtra.

Bank of Maharashtra Overview

Bank of Maharashtra is a public sector bank headquartered in Pune, India. The bank was founded in 1935 and has since grown to become one of the largest banks in the country with over 2,263 branches and 30 million customers. Bank of Maharashtra is a leading provider of a wide range of financial products and services to individuals, businesses, and institutions. The bank’s core business activities include:

- Personal banking: The Bank of Maharashtra offers a wide range of personal banking products and services, including savings accounts, checking accounts, loans, and investments. The bank also offers a variety of digital banking solutions, including online banking and mobile banking.

- Corporate banking: The Bank of Maharashtra provides a comprehensive suite of corporate banking solutions to businesses of all sizes. The bank’s corporate banking services include working capital financing, term finance, project finance, and trade finance.

- MSME banking: Bank of Maharashtra is a leading provider of MSME banking solutions in India. The bank offers a variety of MSME lending products, as well as a range of non-fund-based services, such as business advisory services and training programs.

- Financial inclusion: The Bank of Maharashtra is committed to financial inclusion and has a strong presence in rural and unbanked areas. The bank has a variety of financial inclusion initiatives, including the Pradhan Mantri Jan Dhan Yojana (PMJDY), which is a nationwide program that aims to provide every Indian citizen with a bank account.

With a market cap of 20,146.51 Cr. companies stand at the 12th position of other banks.

| Company Name | Bank Of Maharashtra |

| Number of Shares | 708.14 Cr |

| Number of Employees | ₹ 7,740.78 Cr |

| ROE | 19.68% |

| P/E | 7.73 |

| 52 Week High/Low | ₹ 36.25/₹ 15.45 |

| Market Cap | ₹ 20,181.91 Cr. |

| Website | https://bankofmaharashtra.in/ |

Presently the Bank of Maharashtra operates with 2029 branches and 1850 ATMs across India majority of the ATMs sir in ruler areas. Companies are expanding their ATMs in rural areas so that they can reach every village.

In a simple way, the company will increase its bank’s ATMs and branches and expand its businesses and the share price will also be increased. Fast one year the Bank of Maharashtra gave an amazing return of 83.55%. Bank of Maharashtra’s target for 2025 is 52 rupees.

Bank of Maharashtra has a loan book of corporate and other categories consisting of 42% of the loan book followed by retail is 26% MSME at 19% and agriculture is 13%. In the agriculture year, Bank growth is 8.68% in the retail sector early growth is 23.12% and MSME yearly growth is in a

And the company’s interest rate is growing by around 25.81%. Bank of Maharashtra’s share price in 2030 will be after 7 years of Rs 70.

Non-performing asset companies continuously reduced in March 2022 the non-performing assets were 0.97% in December 2022 the non-performing acid is 0.47% means companies working well only not performing assets.

By reducing the nonperforming asset company’s total business will increase this place increase by the previous year’s 15.77% total deposits increase by 11.69% net profit increase by 1:30.7% and operating profit increase by 35.94%.

As the company performs well in this sector according to the current scenario the share price target of Bank of Maharashtra in 2040 is estimated at Rs 210.

To increase customers the company has launched a new product like they have a super home loan which they have zero processing fees and the lowest interest rate they also have a mass supercar loan in which you can get a quick process with no prepayment charges and attractive interest rate and they also have maha Bank gold loan.

And Bank of Maharashtra also lost its online service they launched date chart boards online loans you can apply from the Bank of Maharashtra portal and you can also get WhatsApp banking on several 7066 036 640. Bank of Maharashtra’s share price target in 2050 is Rs 630.

| Years | Target Price (Approx.) |

| 2025 | Rs 52 |

| 2030 | Rs 70 |

| 2035 | Rs 110 |

| 2040 | Rs 210 |

| 2045 | Rs 320 |

| 2050 | Rs 630 |

SWOT Analysis Bank of Maharashtra

Strength

- Company stock provides good return

- Stock share P values 7.36

- The company has a good amount of free cash flow in 2022 they have 6923.81 Cr

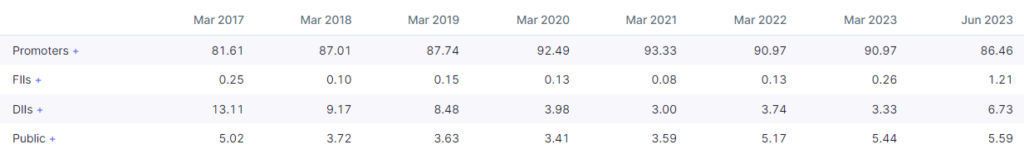

- The company has a promoter holding of 90.97%.

Weakness

- The company’s current ratio is 8.44% and the industries ratio is 10.95%

- The company is in intense competition

- The international presence of a company is a week

Opportunity

- The company has a scope for growth in the international market.

- They have more scope to expand their ATM branches in rural areas.

Threat

- A new banking license can affect the Bank of Maharashtra

- Banks as more competitive than the other banks.

- Banks have cyber security risks and data breaches may happen the Bank of Baroda to avoid this type of risk, Bank of Maharashtra need to invest in cyber security and protect their customer data.

Readers like to Read

Bank of Maharashtra Peers Companys

Conclusion

Overall the financials of the companies are good company growing year on year and reducing their non-performing assets apart from that all the company thread opportunities and weaknesses are already explained.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

FAQ

What is the Bank of Maharashtra Share Price Target 2025?

Bank of Maharashtra’s Share price target for 2025 is between Rs 45 to Rs 52.

What is the Bank of Maharashtra Share Price Target 2030?

Bank of Maharashtra’s Share price target for 2025 is between Rs 65 to Rs 70.

Is it good for the Bank of Maharashtra share for Long Term?

Yes, the Stock is performing well in the market last year’s return was 83.28%.

What is the dividend of BOM 2023?

₹ 1.30 Mar 2023.

Is the Bank of Maharashtra profitable?

Yes, the Bank of Maharashtra is Profitable, Profit growth of the company is 125.96 %.