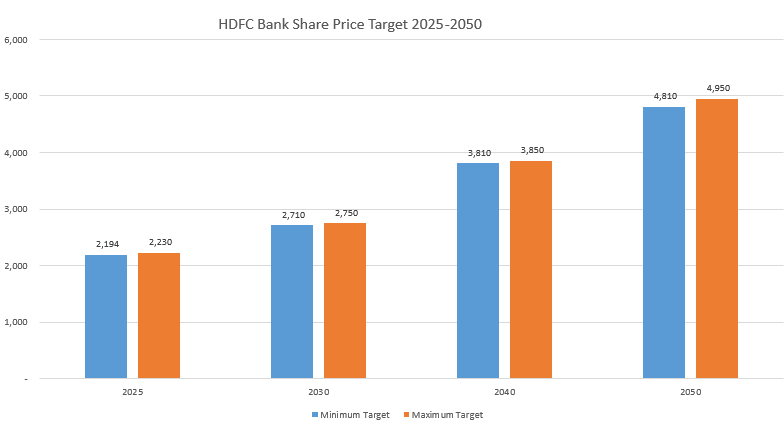

HDFC Bank share price in 2025 minimum is will be Rs 2194 and the maximum will be Rs 2230.

Hello Investors, In this article, we are going to find HDFC Bank Share Price Target for the future. Based on company financials and previous years’ returns we will try to predict the future price of HDFC Bank. We will also analyze the company’s future potential.

About HDFC Bank

HDFC is 4th largest bank in the world after its merger with HDFC. HDFC Bank was established in 1994 in August. The company registered in the Mumbai office is mainly engaged in providing banking services and financial services to retail banking and wholesale banking.

The company did 21% of growth from 2013 to 2023 in advance. the company always works on the features and opening a new branch in quarter few 638.

Banknifty Is trading at Higher levels. from this point, Bank nifty will correct.HDFC Bank is a major player in the banking sector. The HDFC Bank was incorporated in 1994. This is India’s first bank to issue international debit card partnerships with Visa.

Key Points

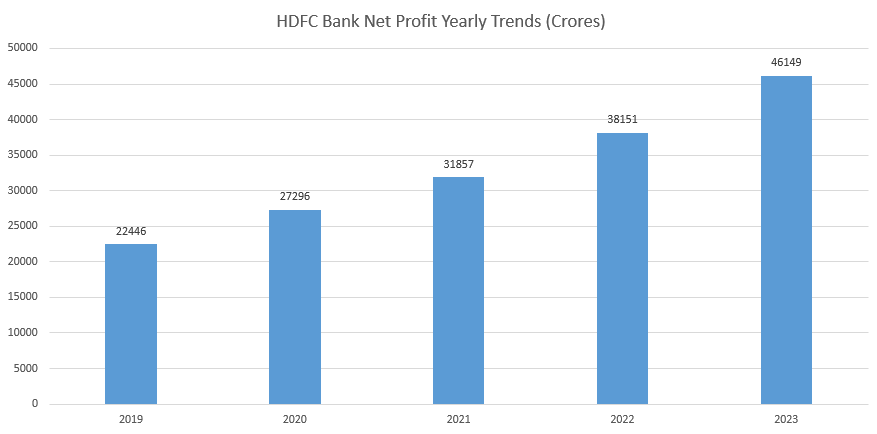

- Over the past 5 years company delivered 20.0% CAGR growth.

- The company maintains a healthy dividend payout.

HDFC Bank Overview

| Company Name | HDFC Bank Ltd. |

| Market cap | ₹ 9,27,455.75 Cr. |

| P/E | 21.03 |

| Number of Shares | 559.18 Cr. |

| ROE | 16.67 % |

| Profit Growth | 18.78 % |

| 52 Week High/Low | ₹ 1,734.45/₹ 1,330.05 |

| Website | https://www.hdfcbank.com/ |

The company’s past one-year returns are 20.59%. HDFC Bank’s Quarter-On-Quarter results are also good.HDFC Bank’s net profit increased from the previous year to this year by 17.3%. if HDFC Bank gives the same returns in the upcoming year, then the

HDFC Bank Q2 2013 9.4% to 14781.1 crore. HDFC Bank delivers a good profit growth of 19.9% CAGR over 55 years and the company also maintains a healthy dividend payout of 19%.HDFC Bank share price in 2025 minimum is will be Rs 2194 and the maximum will be Rs 2230.

HDFC Bank leader in payment. The efficient payment eco-systems. Every third rupee payment is made by HDFC Bank card. HDFC has issued almost 3.21 Crore debit cards and 1.45 Crore credit cards.

Along with HDFC bank as a also international footprint they have an office in Braihan Hong Kong UAE Kenya where they offer The NRI client offshore the bond equity mutual fund treasury structure. In the upcoming coming these issues more. HDFC Bank’s share price’s first Target is 2710 and the second target is 2750.

HDFC Bank is the second biggest receiver of direct taxes. It is the top middle-market bank, capturing 60% of the market. It has one of the largest banking networks in smaller towns and rural areas of India.

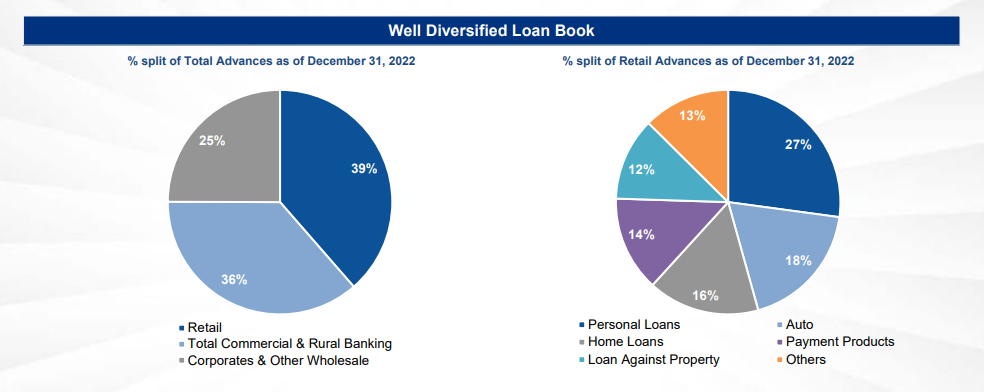

HDFC Bank is a prominent player in providing loans for cars, including passenger vehicles, commercial vehicles, and two-wheelers.

It leads the market in various asset categories and maintains a high-quality portfolio.

HDFC Bank is the market leader in cash management services. HDFC Bank share price’s first Target is approximately Rs 3810 and the second target is approximately Rs 3850.

Now let’s check the company Customer Base – 70 Mn+

Banking Branches – 6.3K+

Banking Outlets – 21K+

Balance sheet size – 20,68,535 Cr.

The company has a strong footprint in India. Past 5 years company sales growth is 15% which is good and the company maintains sales. The company had a strong cash flow in March 2023 Rs 41,330. Crores. HDFC Bank’s share price first Target is approximately Rs 4810 and the second target is approximately Rs 4950.

| Years | Minimum | Maximum |

| 2025 | Rs 2194 | Rs 2230 |

| 2030 | Rs 2710 | Rs 2750 |

| 2040 | Rs 3810 (Approx) | Rs 3850 (Approx) |

| 2050 | Rs 4810 (Approx) | Rs 4950 (Approx) |

HDFC Bank Strengths and Weakness

Strength

- HDFC Bank revenue has grown at a yearly rate of 14.24%, vs. an industry average of 10.26%.

- HDFC Bank’s market share increased from 21.41% to 25.75%

- Company net income has grown at a yearly rate of 20.02%, vs. an industry average of 17.6%.

Weakness

- Past 5 years current ratio has been 10.24%, vs. the industry average of 12.19%.

- Contingent liabilities of Rs.14,57,166 Cr.

- HDFC Stock is trading at 3.67 times its book value.

There are many factors that can affect the share price of HDFC Bank. Some of the most important factors include:

- Macroeconomic factors: These include interest rates, inflation, GDP growth, and monetary policy decisions by the Reserve Bank of India (RBI). As a leading player in the banking sector, HDFC Bank’s share price is sensitive to changes in these factors.

- Company-specific factors: These include the bank’s financial performance, its asset quality, its capital adequacy ratio, and its management. Any negative news about the bank’s performance or financial health can have a significant impact on its share price.

- Global factors: These include changes in the global economy, such as the US interest rate cycle, the European debt crisis, and the Chinese slowdown. These factors can have an indirect impact on HDFC Bank’s share price through their impact on the Indian economy and the Indian financial markets.

- Investor sentiment: This is a more subjective factor, but it can also have a significant impact on HDFC Bank’s share price. If investors are bullish on the Indian economy and the banking sector, then they are more likely to buy HDFC Bank shares, which will drive up the share price. Conversely, if investors are bearish on the Indian economy or the banking sector, then they are more likely to sell HDFC Bank shares, which will drive down the share price.

| Share Holder | Percentage of Share |

| Promoters | 25.59% |

| FIIs | 32.24% |

| DIIs | 28.09% |

| Public | 13.91% |

| Government | 0.16% |

Expert Opinion on HDFC Bank

Money control 31 analysts. 94% have but call on HDFC Bank. On Economics Times 37 analyst has a strong buy call on HDFC Bank.

According to a recent survey of analysts, the majority of them have a “Buy” or “Strong Buy” rating on HDFC Bank shares. The average target price for the stock is around 1950 rupees, which implies an upside potential of around 18% from the current price.

Some of the reasons why analysts are bullish on HDFC Bank include:

- The bank’s strong financial performance. HDFC Bank has been consistently profitable over the past few years, and its financial metrics are among the best in the industry.

- The bank’s strong growth potential. The Indian banking sector is growing rapidly, and HDFC Bank is well-positioned to capitalize on this growth.

- The bank’s strong brand and reputation. HDFC Bank is one of the most trusted banks in India, and this gives it a competitive advantage.

Of course, there are also some risks to consider before investing in HDFC Bank shares. These include:

- The rising interest rate environment. Rising interest rates could put pressure on the bank’s margins.

- The slowdown in the Indian economy. A slowdown in the Indian economy could also impact the bank’s performance.

- The regulatory environment. Changes in the regulatory environment could also impact the bank’s business.

Overall, the expert opinion on HDFC Bank shares is positive. The bank has a strong track record, and it is well-positioned to benefit from the growth of the Indian banking sector. However, investors should also be aware of the risks before investing in the stock.

- Motilal Oswal: “We maintain our ‘Buy’ rating on HDFC Bank with a target price of Rs 1950. We believe that the bank is well-placed to benefit from the growth of the Indian economy and the banking sector.”

- Kotak Institutional Equities: “We have a ‘Buy’ rating on HDFC Bank with a target price of Rs 2000. We believe that the bank’s strong financial performance and growth potential will continue to drive its stock price higher.”

- Nomura: “We have a ‘Buy’ rating on HDFC Bank with a target price of Rs 1900. We believe that the bank is one of the best-managed banks in India, and it is well-positioned to benefit from the growth of the Indian economy.”

Ultimately, the decision of whether or not to invest in HDFC Bank shares is a personal one. Investors should carefully consider all of the factors involved before making a decision.

Conclusion

HDFC Bank has a strong balance sheet. According to ticker tape analysts 95% recommended. In the future company growth. This is one of the biggest banks in India.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

Is HDFC a good buy now?

Money control 31 analysts. 94% have but call on HDFC Bank.

Is HDFC good for the long term?

Yes, the company has a strong balance sheet and the past 5 years returns are 57.30%.

Why HDFC is better than SBI?

HDFC is a big company that provides a smooth ecosystem to customers.

Is HDFC bigger than SBI?

Yes, HDFC is bigger than SBI.

What is HDFC Bank share price target in 2025?

HDFC Bank share price in 2025 minimum is will be Rs 2194 and the maximum will be Rs 2230.