In this article, we going to forecast IDFC First Bank Share Price Target. IDFC Bank is a private sector bank in India that was formed in 2004 through the merger of IDFC Limited and The First Bank of India. The bank has a strong focus on retail banking, wealth management, and corporate banking.

- The bank has a strong capital base with a Tier-1 capital ratio of 13.5% as of March 2023.

- The bank has a wide branch network of over 1,500 branches and 3,000 ATMs across India.

- The bank offers a wide range of products and services, including savings accounts, fixed deposits, loans, credit cards, and wealth management services.

- The bank has a good track record of profitability, with net profits of over INR 1,000 crore in the last financial year.

- The bank is well-managed with a strong board of directors

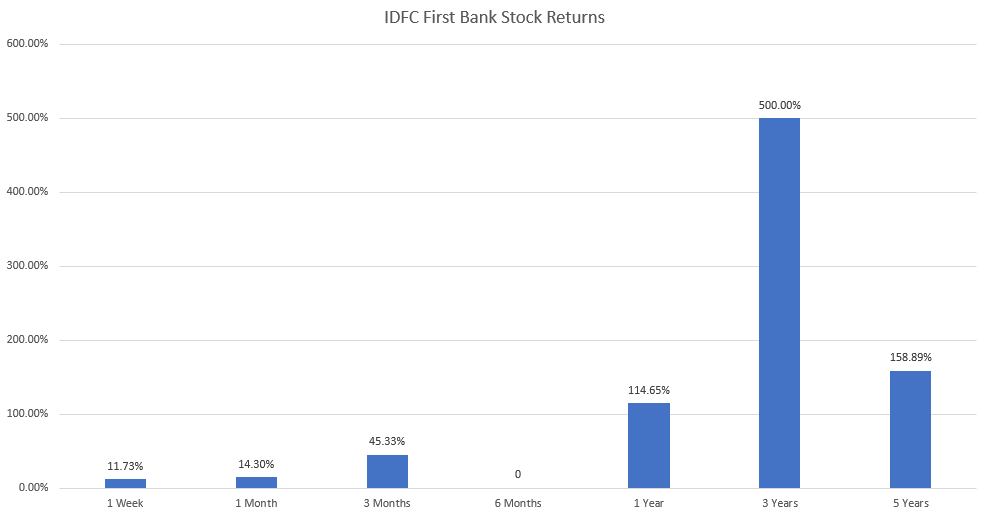

IDFC Stock Returns

IDFC Bank: A Brief Overview

While doing fundamental analysis some ratios are important like the P/E ratio, Current ratio, debt-to-equity ratio, and company balance sheet.

| Company Name | IDFC First Bank Ltd. |

| Market Cap | ₹ 53,754.57 Cr |

| P/E Ratio | 22.06 |

| Sector P/E | 5.23 |

| Debt | ₹ 1,58,502 Cr |

| Free Cash Flow | 2,197.29 |

| Number of Shares | 662.82 Cr |

| Sale Growth (3 Years) | 12% |

| Net Profit (3 Years) | 42% |

| Website | https://www.idfcfirstbank.com/ |

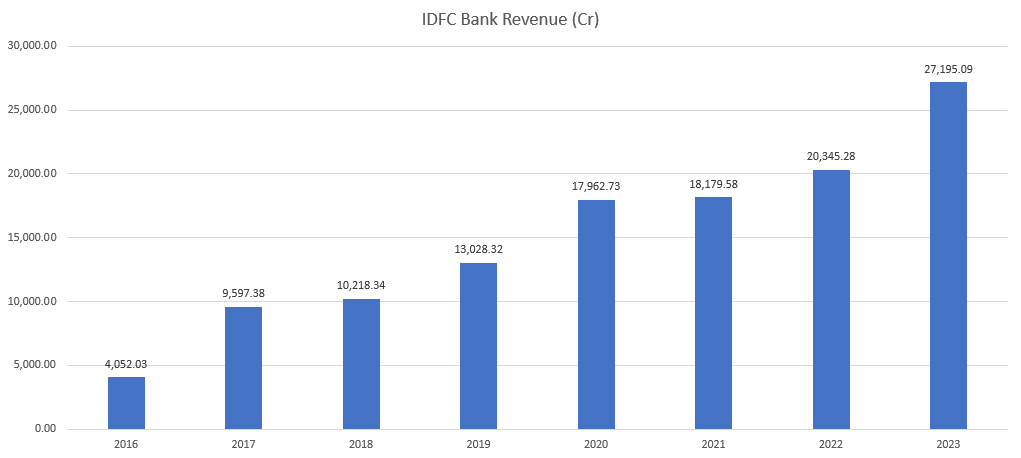

Last month IDFC bank stock rate was 11.33% and last year’s return of this bank was 144.06%. if a stock gives the same return in the next 2 years. IDFC’s first bank revenue is always growing really high with an average rate of 21.62% in the industry of an average 12.02%.

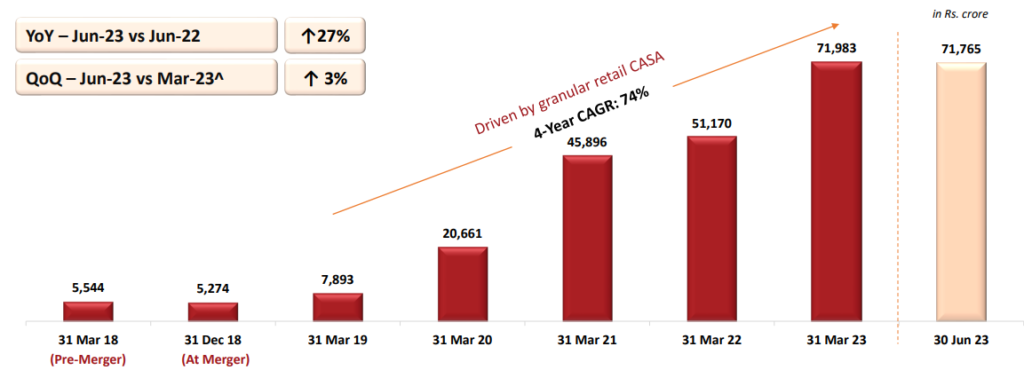

In the last 5 years, the company’s market share has increased from 2.3% to 3.49%. and the company has good early growth in the financial year 2023. By 2023 the total revenue of a company will increase by 33.67%.

Then the profit of a company’s cotton quarter increases and the year on your business is also increasing in March 2022 the company’s properties are Rs 132 crores now in March 2023 the operating profit is Rs 2485 crore. IDFC First Bank Share Price Target for 2025 minimum is Rs 90 and the maximum is Rs 150.

IDFC bank currently has 641 branches and 719 ATMs across India in the future this will increase. The company is also moving to a digital cash management solution like trade forex and wealth management fast tool acquiring business and credit card business. If the company is the same way you’re calling more business and expanding the company then the IDFC First Bank Share Price Target for 2025 minimum is Rs 160 and the maximum is Rs 290.

Currently IDFC Bank stock is trading at a higher level. The company is weak in making a profit from financials because in December 2022 the financing profit was -326 crore and in March 2023 this profit reduced a little bit -303 crore. In the end, however, the net profit of a company is always positive in 2023 a profit of 816 crore. IDFC First Bank Share Price Target for 2025 minimum is Rs 510 and the maximum is Rs 620.

Now will talk about how the company has grown in the past 3 years the sales growth of the last 3 years is 12% and the profit growth of the company over the past 3 years is 42% means companies making more profit and if you see the return on equity of past 3 years that would you 5% but if you see last 5 year written on equity that would be an – 2%. IDFC First Bank Share Price Target for 2025 minimum is Rs 890 and the maximum is Rs 980.

| Years | Minimum Target | Maximum Target |

| 2025 | Rs 55 | Rs 150 |

| 2030 | Rs 220 Estimated | Rs 280 Estimated |

| 2040 | Rs 510 Approx | Rs 620 Approx |

| 2050 | Rs 890 Approx | Rs 980 Approx |

Company Shareholding Pattern

- The largest shareholder in IDFC Bank is the Life Insurance Corporation of India (LIC) with a 10.1% stake.

- Other major shareholders include HDFC Bank (9.5%), IDFC Limited (8.9%), and ADIA (7.7%).

Company Strengths and Weaknesses

- Strengths: Strong capital base, wide branch network, a wide range of products and services, good track record of profitability, well-managed.

- Weaknesses: High operating costs, exposure to the retail sector, and cyclicality of the banking industry.

Peers

- Some of the peers of IDFC Bank include HDFC Bank, Axis Bank, ICICI Bank, and Kotak Mahindra Bank.

The following factors could affect the IDFC Bank share price target:

- The overall performance of the Indian economy

- The performance of IDFC Bank’s business

- The bank’s financial performance

- The bank’s regulatory environment

- The bank’s management team

You can track the IDFC Bank share price through a variety of channels, including:

- The bank’s website

- Financial news websites

- Financial websites

- Stock exchanges

Conclusion

IDFC Bank is a well-managed private sector bank with a strong track record of profitability. The bank has a wide range of products and services and a good distribution network. The bank is well-positioned to grow in the future.

FAQ

What is the IDFC Bank share price target for 2025?

The IDFC Bank share price target for 2025 is between ₹105 and ₹125. This is based on the assumption that the bank will continue to grow its business and improve its profitability.

What is the IDFC Bank share price target for 2030?

The IDFC Bank share price target for 2030 is between ₹200 and ₹250. This is based on the assumption that the bank will continue to grow its business and improve its profitability and that the overall Indian economy will grow at a healthy pace

What is the IDFC Bank share price target for 2040?

The IDFC Bank share price target for 2040 is between ₹350 and ₹400. This is based on the assumption that the bank will continue to grow its business and improve its profitability and that the overall Indian economy will grow at a rapid pace.