Looking for the IEX Share Price Target 2025-2030-2040-2050. We will be sharing details on the share price Targets.

Based on previous year returns and stock fundamental analysis we are going to predict the future price of IEX share price.

The Indian Electricity Regulatory Commission licenses this India power energy exchange for support trading in power electricity and trading of a renewal certificate and energy saving certificate.

The main activity of IEX is to provide an automatic platform and infrastructure for carrying out trading in electricity units for the physical delivery of electricity.

IEX Company Overview

Indian Energy Exchange (IEX): This is an Indian electronic system-based power trading exchange, established in 2008. It functions under the regulation of the Central Electricity Regulatory Commission (CERC). IEX provides a nationwide automated trading platform for participants in the power market, including:

- State Electricity Boards

- Power producers

- Power traders

- Open Access Consumers (industrial & commercial)

IEX facilitates the physical delivery of electricity, renewables, and certificates through its platform. They also recently ventured into cross-border electricity trade, aiming to create a larger South Asian Power Market.

| Company Name | Indian Energy Exchange Ltd |

| Market Cap | ₹ 11,070 Cr. |

| P/E | 37.1 |

| Sector P/E | 25.5 |

| Debt | ₹ 14.1 Cr. |

| Return over 3years | 24.8 % |

| ROE | 39.4 % |

| 52 Week High/Low | ₹ 165 / 116 |

| PROFIT GROWTH | 24.54 % |

| Website | http://www.iexindia.com/ |

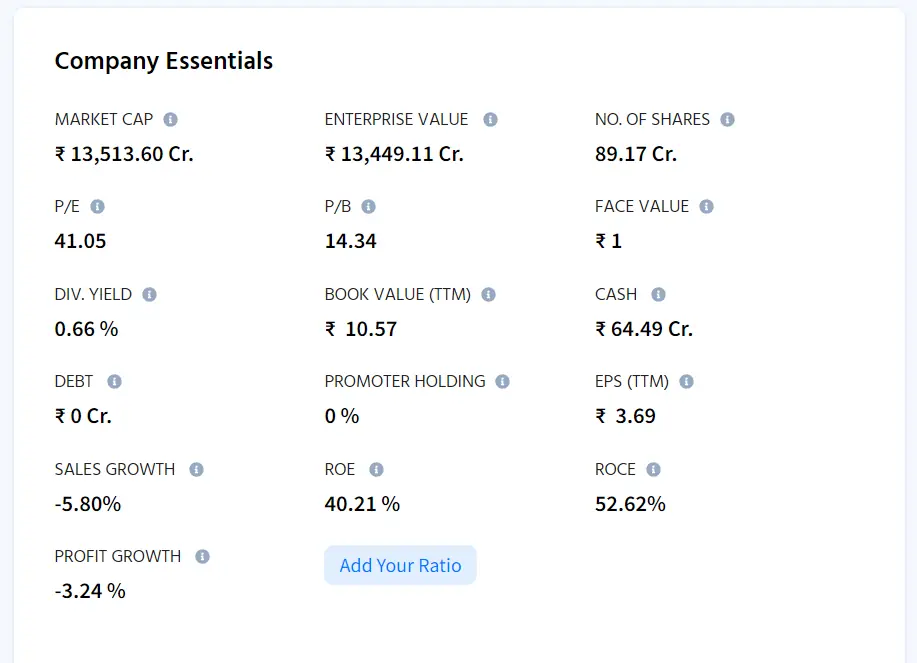

Predicting IEX share price targets based on its fundamental analysis can be a good way. The company has witnessed good growth. IEX company is a debt-free company with an ROE ratio of 40%.

IEX’s market value accurately reflects its operating assets, with a market capitalization of ₹ 13,184 Cr, which is equal to its enterprise value.

IEX has a good P/E ratio of 41.05, shares are priced for high projected profit growth. The 14.34x P/B ratio indicates the market’s optimism regarding IEX’s potential for further growth.

Even if the dividend yield is only 0.66%, return statistics show remarkable profit gains, with ROE standing at an astounding 40.21% and ROCE at an even higher 52.62%.

IEX has demonstrated exceptional profitability and growth potential in its financial condition and operational performance, which is anticipated to generate returns for investors.

Let’s have a future look at the IEX share price target.

IEX share’s 3-month return is -21.7 and 6 months return is negative the previous two-year return of the company is not good but the company’s past five-year return is 132.92%. This is India’s first energy exchange and largest energy exchange in India. This is an automatic trading platform for physical delivery of electricity. This is a monopoly business.

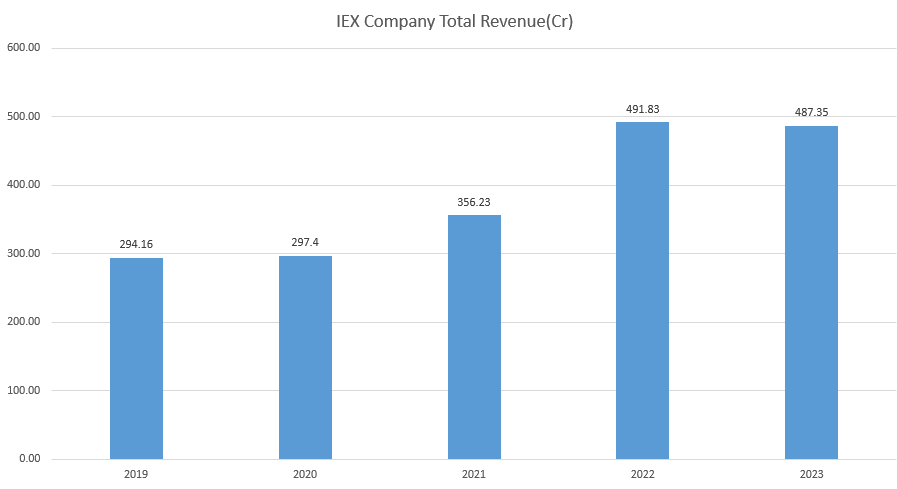

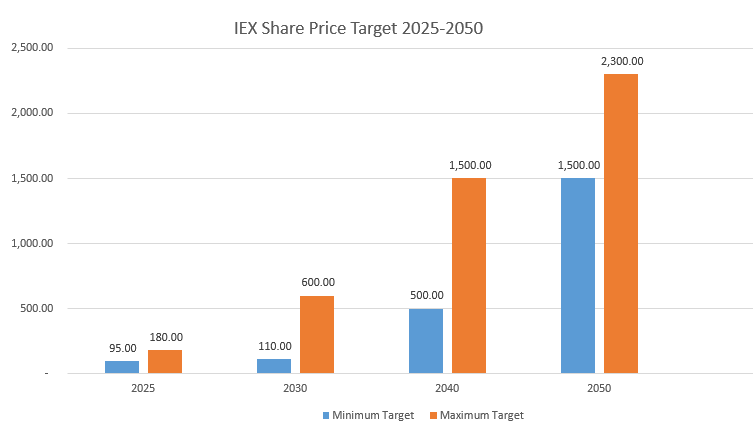

IEX FY2023 revenue is Rs 487.35 Cr less than previous years was FY2022 Rs 491.83 Cr. The company’s past 5 years revenue has grown at a yearly rate of 13.74%, vs. the industry average of 9.39%. IEX Share Price Target minimum is Rs 95 and the maximum is Rs 180.

Now we see how the IEX company is registered in other states. IEX has 7300 plus registration participants from 36 states and union territories. Out of the participants registered to trade electricity contracts in 257 distribution companies, over 620 electricity generators, and 60,645 open access consumers.

IEX Maintain good OPM of more than 80%. Company operating Profit in March 2023 was Rs 336 Cr against FY2022 was Rs 366 Crores. According to Analysis EX Share Price Target 2030 minimum is 110 and the maximum is Rs 600.

Readers also Like to Read

The company has the good advantage of having a Monopoly business because its overall market share of 94.2% and its market share is 99.9% in Dam and RTM there are only two energy exchanges in India first is IEX and PXIL and enjoy the majority of this year however HPX is a third and newest power exchange promoted by the BSc PTC India and ICICI Bank begins operation on 6 July 2022.

| Return on Equity | |

|---|---|

| 10 Years: | 43% |

| 5 Years: | 44% |

| 3 Years: | 44% |

| Last Year: | 39% |

Due to their Monopoly business, the company may take advantage and the future and share price target of IEX in 2040 minimum is Rs 500 and a maximum of Rs 1500.

Now let’s talk about the company’s key statistics a daily average Traded volume was 187 million units in 2022 and a total of 102 billion units of electricity were traded in the financial year 2022 more than 4400 commercial and the industrial consumer across India representing a variety of industries sector such as a textile metal chemical automobile home product food cement institution commercial consumers etc achieve 37% year on your growth across all the market segment in 2022.

| Compounded Sales Growth | |

|---|---|

| 10 Years: | 11% |

| 5 Years: | 12% |

| 3 Years: | 16% |

| TTM: | 7% |

The company balance sheet is fine and sales growth has been good last 3 years is 16% and last 5 years 12% company had a good net cash flow in March 2021 and 2022 but in 2023 company had a minus 167 CR net cash flow.

IEX Share Price Target 2050 minimum is 1500 and the maximum is Rs 2300.

| Years | Minimum Share Price Target | Maximum Share Price Target |

| 2025 | Rs 95 | Rs 180 |

| 2030 | Rs 110 Estimated | Rs 600 estimated |

| 2040 | Rs 500 (Approx) | Rs 1500 (Approx) |

| 2050 | Rs 1500 (Approx) | Rs 2300 (Approx) |

Strength

- The company has a good compounding profit growth last 3 years is 20% last 5 years 19%

- IEX is almost a death-free company

- 0 The company has a good return on equity

- Maintain a healthy dividend payout of 48.6%

Weaknesses

- The stock is trading at 14.4 times its book value. The top P/E ratio is still 38.6.

- FIIs decrease their holding.

IEX has a good advantage of having a monopoly business. this only one in India whose company has a license to trade electricity. In the future, we all know that the electricity demand will increase in India. As stock past returns are not very stable their lots of ups and down. After 10 Years IEX’s share price can reach Rs 1000.

Motilal Oswal is well know firm that helps investors to invest money and help gain knowledge. In recent no target announced by Motilal Oswal for IEX share. But ICICI Direct gave the same target for IEX 195 and 285.

Conclusion

The company has a Monopoly business which is the main advantage of IX business but the stock has been struggling for the past 1 year after the Ukraine Russia. The stock also got split after that the strong were not performing well but the stock is fundamentally good the fundamentals are good and the stock will perform in the future.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

FAQ

What will be the share price of IEX in 2030?

The share price target of IEX for 2030 is Rs 600.

What will be the share price of IEX in 2040?

The share price target of IEX for 2030 is Rs 1500 approx.

Is IEX debt debt-free company?

Yes, IEX is an almost debt-free Company.

What will be the share price of IEX in 2025?

IEX Share Price Target minimum is Rs 95 and the maximum is Rs 180.