Are you trying to find the future of the IOB Bank Share Price Target for the 2025-2030? Are you currently holding shares of IOB Bank? If the answer is yes, then this article is just for you. We will dive into IOB’s Share Price Target and conduct an in-depth analysis of the company’s financials.

Banks play a pivotal role in our modern economy, serving as the bedrock of financial stability and economic growth.

Economic growth is important for a country because it ensures better infrastructure. For example, IRFC is improving the Indian railway system.

So in this article, we are going to discuss the Indian overseas Bank financials and some ratios and do a short message on IOB Bank also we will forecast some future prices of Indian overseas banks.

Currently, the Indian Overseas Bank is trading at 41 rupees. The first six-month return is not good in an Indian overseas Bank if you see the Bank Nifty trading at a higher level but the Indian Overseas Bank is not.

Indian Overseas Bank overview

Indian Overseas Bank was founded in 1937 in Chidambaram. IOB is a public sector bank with a market cap of 45640 CR the stock rank is 128 position in a midcap.

| Company Name | Indian Overseas Bank |

| Market Cap | ₹ 77,783 Cr |

| Debt | ₹ 444 Cr. |

| P/E Ratio | 33.4 |

| Sector P/E | 41.8 |

| Debt to Equity ratio | 11.2 |

| ROE | 4.53 % |

| Dividend Yield | — |

| 52 Week High/Low | ₹ 51.1 / 18.2 |

| Profit Var 3Yrs | 31.0 % |

| Website | http://www.iob.in/ |

Understand how big the bank is presently the bank operates with 3200 branches and 3000 ATMs across India and the majority of the branches are located in a ruler and semi-urban area. That means they want to expand their business in rural areas so that every person can connect.

This is one type of strategy because, in most of the Big Bang car metro cities, their banks are not available in rural areas so they try to capture the areas where the bigger bank is not available.

| Minimum Price | Maximum Price | |

| January 2025 | ₹75 | ₹78 |

| February 2025 | ₹78 | ₹81 |

| March 2025 | ₹81 | ₹84 |

| April 2025 | ₹84 | ₹87 |

| May 2025 | ₹87 | ₹90 |

| June 2025 | ₹90 | ₹93 |

| July 205 | ₹93 | ₹95 |

| August 2025 | ₹95 | ₹98 |

| September 2025 | ₹98 | ₹101 |

| October 2025 | ₹101 | ₹104 |

| November 2025 | ₹104 | ₹107 |

| December 2025 | ₹107 | ₹110 |

IOB Bank Share Price Target 2025 minimum is Rs 75 and the maximum is Rs 110.

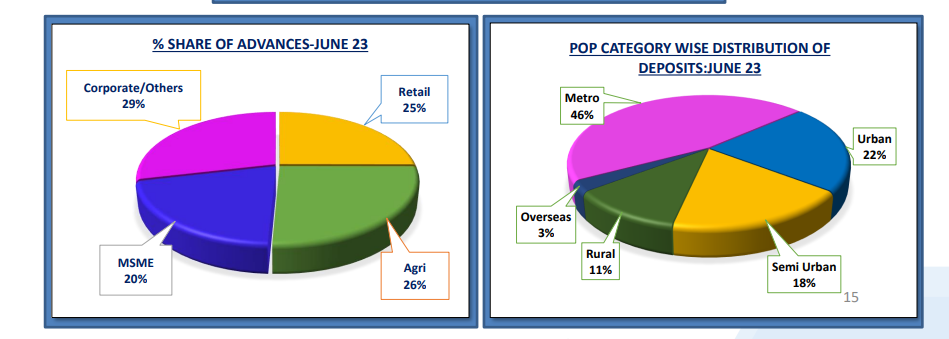

IOB Bank as a diversified loan book retailer category accounts for 27% of loan book followed by the agreed 27% MSME 24% cooperative and 22% retail book home loans account for 48% of loan book education loans is 14% and 9% and other 29%.

Indian Overseas Bank as a healthy loan book. Let’s see what the return from the loan is. IOB as an interest income year-on-year growth is 20.43%. if the same company at least maintains 15% of growth every year.

| Minimum Price | Maximum Price | |

| January 2030 | ₹120.00 | ₹128.75 |

| February 2030 | ₹128.75 | ₹137.50 |

| March 2030 | ₹137.50 | ₹146.25 |

| April 2030 | ₹146.25 | ₹155.00 |

| May 2030 | ₹155.00 | ₹163.75 |

| June 2030 | ₹163.75 | ₹172.50 |

| July 2030 | ₹172.50 | ₹181.25 |

| August 2030 | ₹181.25 | ₹190.00 |

| September 2030 | ₹190.00 | ₹198.75 |

| October 2030 | ₹198.75 | ₹207.50 |

| November 2030 | ₹207.50 | ₹216.25 |

| December 2030 | ₹216.25 | ₹225.00 |

IOB Bank Share Price Target 2030 minimum is Rs 120 and the maximum is Rs 225.

IOB Bank is also internationally present, presently the bank has 6 established abroad including overseas branches 1 Remittance center one joint venture subsidiary it has one branch each in Singapore Hong Kong Bangkok Colombo, and a Remittance center in Singapore and JB subsidy functioning in Malaysia overseas deposit for 2% of total deposit of bank.

IOB will increase its international presence which help the company to grow. According to company performance. IOB Bank Share Price Target 2040 minimum is Rs 250 and the maximum is Rs 350.

The bank has the highest level of involvement in the agriculture industry, accounting for 15.1% of its overall exposure.

| By Month | Minimum Price | Maximum Price |

| January 2050 | ₹250 | ₹259 |

| February 2050 | ₹259 | ₹268 |

| March 2050 | ₹268 | ₹278 |

| April 2050 | ₹278 | ₹287 |

| May 2050 | ₹287 | ₹296 |

| June 2050 | ₹296 | ₹305 |

| July 2050 | ₹305 | ₹314 |

| August 2050 | ₹314 | ₹323 |

| September 2050 | ₹323 | ₹333 |

| October 2050 | ₹333 | ₹342 |

| November 2050 | ₹342 | ₹351 |

| December 2050 | ₹351 | ₹360 |

This is closely followed by housing at 14%, infrastructure at 11%, trade at 8.6%, non-banking financial companies (NBFCs) and professional services at 4.4% each, housing finance companies (HFCs) at 3.5%, and various other sectors.

IOB Bank Share Price Target 2050 minimum is Rs 370 and the maximum is Rs 420.

Maharashtra Executor & Trustee Company Pvt Ltd (METCO) is a fully-owned subsidiary of the bank.

METCO offers a range of additional services to support banking operations.

These services include providing consultation on various matters, assisting with the creation and implementation of wills, managing investments, overseeing the property of minors, and offering guidance for property transactions like sales and purchases.

IOB Bank Share Price Target 2025 minimum is Rs 510 and the maximum is Rs 600.

Readers like to reads

- HDFC bank target Price 2030

- Bank of Maharashtra Share Price Target 2025

- IDFC Bank Share Price Target 2030

| Years | Minimum Target | Minimum Target |

| 2025 | Rs 75 | Rs 6 |

| 2030 | Rs 120 | Rs 225 |

| 2040 | Rs 250 Estimated | Rs 360 Estimated |

| 2050 | Rs 370 Estimated | Rs 420 Estimated |

| 2060 | Rs 510 | Rs 600 |

IOB Bank Strengths and Weakness

Strength

- CASA (Current Account and Savings Account) represents a significant portion of the total deposits, amounting to 43.74%.

- The company maintains a healthy Capital Adequacy Ratio of 16.10%, indicating its ability to cover potential risks and meet regulatory requirements.

- Over the past three years, the company has experienced impressive profit growth, reaching a commendable 30.96%. This signifies its ability to generate increased earnings during this period

Weakness

- IOB Bank Could face more competition.

- The bank has consistently performed poorly in terms of return on assets (ROA). Over the past 3 years, its average ROA stands at a mere 0.53%, indicating a low level of profitability.

- The bank has a significant issue with non-performing assets (NPA), which refers to loans that are not being repaid. The average NPA over the last 3 years is high, standing at 2.69%. This suggests a higher risk for the bank and potential challenges in recovering loan payments.

- The bank’s cost-to-income ratio is quite high, reaching 51.94%. This means that a significant portion of its income is being used to cover operating costs, which could impact its overall profitability and financial stability.

- The company has experienced sluggish income growth, with a meager 3.68% increase over the past 3 years. This indicates a lack of strong performance and a limited ability to generate significant revenue growth.

Technical analysis of Indian overseas Bank based on EMA

Currently, the Indian Overseas Bank is trading on 24 rupees if you see it from a technical prospect this is a very good point for buying an Indian overseas Bank The technical chart says if you 1D time frame and use Ema then the candle-taking support at the line

Conclusion

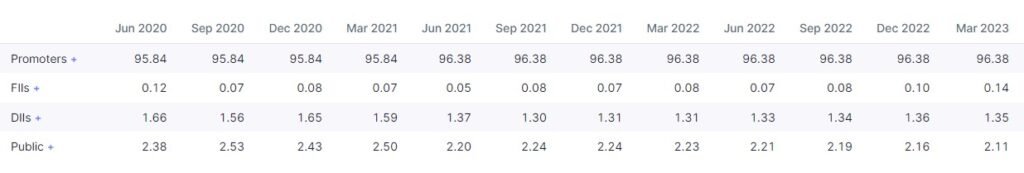

IOB financials are good. company is stable and the company has promoters holding 96.38%. IOB The Gross NPA and Net NPA stood at 7.44 % and 1.83 % respectively as of the latest financial year.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

Is IOB a good stock to buy?

Yes, IOB bank is a Good Stock to Buy target 2025 is Rs 40.

Who is IOB owned by?

IOB is Owned by the government of India which has ₹274,000.35 crore (US$34 billion) (2021) assets.

What is IOB the Share Price Target 2050?

IOB Bank Share Price Target 2050 minimum is Rs 370 and the maximum is Rs 420.

What is IOB the Share Price Target 2025?

IOB Bank Share Price Target 2025 minimum is Rs 75 and the maximum is Rs 110.

What is IOB the Share price Target for 2030?

IOB Bank Share Price Target 2030 minimum is Rs 120 and the maximum is Rs 225.