If you are interested in investing in Plug Power Stock Prediction. Then this article is for you. In This article, we are going to understand the Plug Power company business model and do a stock fundamental analysis.

For the best time entry in this stock, we will use technical analysis. Currently plug stock is trading at $12.39.Currently, the stock is in an uptrend

Plug Power Company Overview

Plug Power Company was started in 1997 as a joint venture after 2 years it went publically in 1999.

Plug Power is a leading provider of hydrogen fuel cell solutions, aiming to build a complete green hydrogen ecosystem. They design, develop, and manufacture fuel cell systems used in material handling vehicles like forklifts, along with stationary fuel cells for data centers and backup power. Additionally, they invest in green hydrogen production, storage, and delivery infrastructure.

| Company Name | Plug Power Inc |

| Market Cap | 7.441B |

| Debt | 7.39 – 31.56 |

| Shares Out | 600.54M |

| Debt to Equity | 15.15% |

| 52 Week High/Low | $31.56/$7.39 |

| ROE | -18.44% |

| EPS | -1.27 |

| Stock P/E | -9.33 |

| Website | https://www.plugpower.com/ |

Plug Power Business

Have you wondered about how Plug Power doing business in the market or what are the services they offer? Here is a closer look at company products.

Products and Services:

- GenDrive: A hydrogen-powered fuel cell engine for material-handling vehicles like forklifts. It offers longer runtime, faster refueling, and lower emissions compared to battery-powered alternatives.

- GenFuel: A liquid hydrogen fueling system, encompassing delivery, storage, and dispensing infrastructure. Plug Power operates over 180 hydrogen fueling stations worldwide, the most of any company.

- GenCare: An IoT-based service program providing ongoing maintenance and on-site support for Plug Power’s fuel cell systems.

- GenSure: A stationary fuel cell solution offering modular power for backup and grid support in various sectors like telecommunications, transportation, and utilities.

- Electrolyzers: Plug Power manufactures PEM electrolyzers used to produce green hydrogen from renewable electricity and water. They’re building a Gigafactory to scale up production and meet the growing demand.

Green Hydrogen Ecosystem:

Beyond individual products, Plug Power envisions a complete green hydrogen ecosystem. This includes:

- Green hydrogen production: Plug Power is investing in building its green hydrogen production plants, aiming to produce 500 tons of liquid green hydrogen daily by 2025.

- Storage and handling: The company is developing safe and efficient technologies for storing and transporting liquid green hydrogen.

- Delivery infrastructure: Plug Power plans to build a “green hydrogen highway” across North America and Europe, facilitating widespread hydrogen adoption.

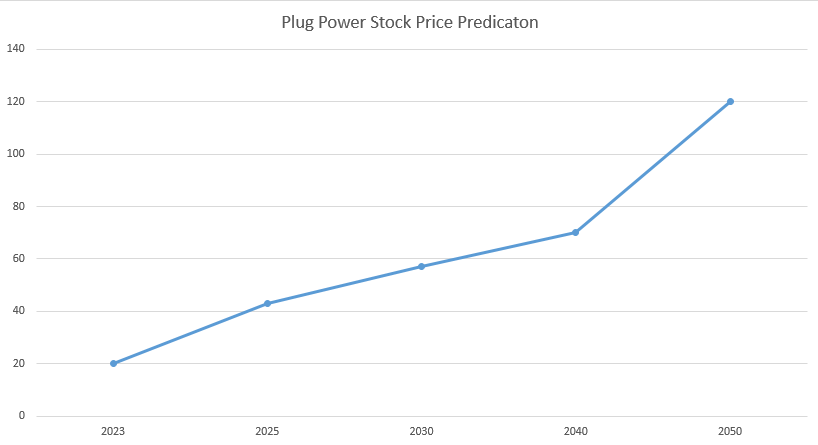

Plug Power Stock Prediction Trends

Plug Power Stock Prediction 2024

Plug stock is trading between 3 to 4$. The Plug Power price is expected to rise by 5$ which means the price of Plug Power in 2024 can reach 8$ minimum and the maximum can go 15$.

Plug Power Stock Prediction 2025

And if you see the past 3 years returns are negative that is -88.78%. the stock was given a nice return in 2020 at that time the stock returned 973.10%. There are both sides if the stock performs as the stock is performing in the first 3 years when the stock is reduced by -88%. And if the stock returns like the stock given in 2020 then the stock price is $43.14.

Plug Power Stock Prediction 2030

Forecasting the share price for 2030 we need to understand companies business.

The company is in the business of making a hydro fuel cell and they have manufactured hydrogen production equipment hydrogen stores and delivery system hydrogen energy generation stations. The company’s customers include Amazon, Walmart, BMW, and DHL. Plug Power’s share price reached 2030 $57.

Plug Power Stock Prediction 2040

Let’s understand some ratios the company’s EPS is -1.33%. The P/E ratio of the company is negative -9.33. As the company has a high debt-to-equity of 15.15%

Plug stock price 2040 $70.

Plug Power Stock Prediction 2050

Company total revenue is increasing quarter by quarter Dec 2022 is $701,440. The company generates revenue but the cost is higher than the company’s revenue so the net profit goes in minus. Pawan share price talk price prediction for 2050 is 120 dollars.

Readers also Like to Read

- HDFC Stock Price Prediction 2025

- Axis Bank Stock Price Prediction 2030

- Infosys Stock Price Forecast for 2030

Plug Power Stock Predication Table 2023-2050

| Years | Plug Power Stock Prediction |

| 2023 | $5 |

| 2024 | $15 |

| 2025 | $43.14 |

| 2030 | $57 Approx |

| 2040 | $70 Approx |

| 2050 | $120 Approx |

Plug Power Stock Strength and Weaknesses

Strength

- The company is a leader in hydrogen fuel cell technology with a global presence and blue-chip customers.

- The company has a strategic partnership with Renault bae system SK Group et cetera to capture the B2B vehicle market.

- The company has strong customers like Amazon, Walmart, DHL

Weaknesses

- The company’s core business performance is in a poor state

- High cost of hydrogen fuel cells and infrastructure.

- Competition from other alternative energy technologies like battery electric vehicles.

- Consistently company’s negative operating income from the past 4 year

Expert Opinion on Plug Power Stock

- According to the Yahoo finance analysis best from the 30 analyses 19 have by and 10 have a hold.

- The chart is from the Trading view forecast.

Conclusion

As you already discuss the company’s strengths and weaknesses we also discuss the company’s major customers and company growth so depending on your decision you can take.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

Power stock 5-Year Forecast

If you see the company’s balance sheet the balance sheet is not good. A company is not generating good revenue from its core business. But the stock has been performing well for a few months. But the stock yearly returns are not good. If we expect from 2023 to 2028 then till 2028 stock price could be reached to $35.

Plug Power Stock 10-year forecast

Power share price after 10 years could reach 62 dollars if a company improves its balance sheet. And reduce their expenses. Then definitely the stock price reaches $62 and that can move to $70 also.

FAQ

What is the P/E ratio of Plug Power Stock Price?

plug power stock P/E is -9.33.

What will PLUG stock be worth in 5 years?

Plug power stock worth in the next 5 years between $30 to $35.

Is Plug Power a good buy?

From the investor side, Plug Power has a rating of buy from Yahoo Finance.

Will Plug Power stock hit $100?

Yes, but not know if the company has more scope to expand the business. If the company starts performing well then the stock easily hits $100.