Tata Power Company is primarily focused on the business of the Generation, transmission, and distribution of electricity. It aims to produce electricity completely through renewable sources. It also manufactures solar roofs and plans to build 1 lakh EV charging stations by 2025.

Hello Investors, Are you Looking for a Tata Power Share Price Target for 2025? As all we know Tata Power is well well-established company. We will do research on these companies based on their product their vision and what their expansion will be in the upcoming year.

Tata Power Company Overview

| Company Name | Tata Power Company Ltd |

| Market CAP | ₹ 71,415.84 Cr |

| P/E | 21.85 |

| Sector | 12.79 |

| Debt | ₹ 21,865.48 Cr |

| Free Cash Flow | -496.88 |

| Number of Shares | 319.53 Cr |

| Growth (YoY) | 24% |

| intrinsic value | 280.82 INR |

| Website | https://www.tatapower.com/ |

Tata power stock returns are not really good fast 3 years are not really stable. The last 3 months’ returns are +7.02% and the last 6 months’ returns are +23.60%.

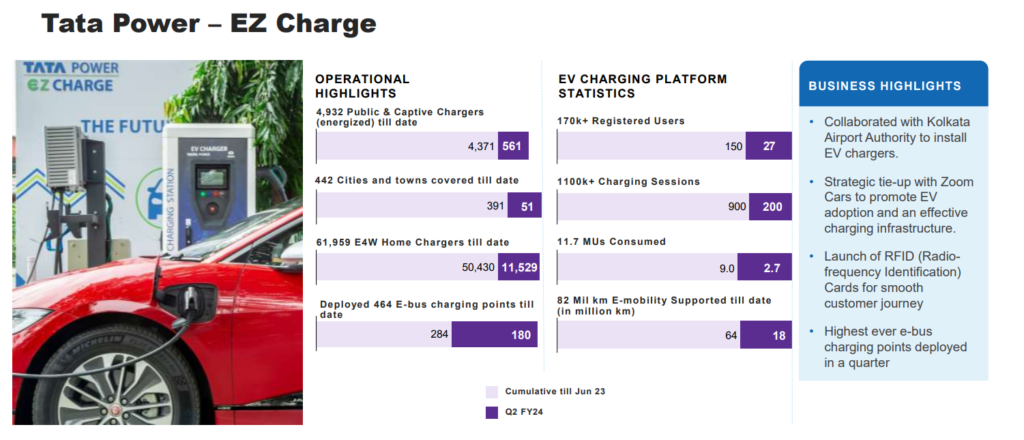

Recently Tata Power set the 450 + EV charging 350 National Highway company has also a strong order book of 393 megawatts worth 1,434 crores for solar rooftops as of 14th September 2022. Tata Power operates in different segments. The company set up the Largest power generation plant in Gujrat that can generate 5,013.5 MW.

Company is a strong relation between the GDP and power demand growth as Indian GDP growth is 5.7% and the power demand is 5.3%. this will be very beneficial for the company. Tata Power Share price target for 2025 minimum price of Rs 280 and the maximum is ₹320.

Tata Power has Diverse revenue sources. the power generation segment generates 64% of revenue, the renewal segment generates 1% of revenue transmission and distribution units 35% of revenue and others generate 1% of revenue.

As this the power demand will increase in the future and the power generation and company revenue will increase hence share price will also increase.

India has one of the lowest power consumption per capita while Norway has the highest unit consumption. It means in future the power consumption will be high in India and power generation demand will increase as the company’s share price will also increase. Tata Power Share Price Target for 2030 minimum price of Rs 924 and the maximum is ₹1220.

IRFC Share Price Target

From the rooftop solar business, the company generated ₹1,097 Cr revenue. Company order book at Q4 and stand 19000 Cr plus channel network cross 650 plus across 275 districts and Q4 financial 2023 billing cross 1000 crore Cr. The company also built solar pumps from that the company generated 97 crores of revenue the order book for a solar pump is also a crore plus and the total pump build is 33,000 in the financial 2023.

Tata Power Share Price Target for 2025 minimum price of Rs 1500 and the maximum is ₹1700.

Company revenue in financial 2022 is 42,576 and this will increase to 56,033 in financial 2023. The company reduced its net debts in the previous year by 2022 to 39,708 and now in Q4 2023, the net is 35,328.

Tata Power gives the same return as in the past 5 years 221%. Tata Power Share Price Target for 2025 minimum price of Rs 2500 and the maximum is ₹2700.

| Years | Minimum Share Price Target | Maximum Share Price Target |

| 2025 | ₹220 | ₹320 |

| 2030 | ₹924 | ₹1220 |

| 2040 | ₹1500 | ₹1700 |

| 2050 | ₹2500 (Approx) | ₹27000 (Approx) |

- According to the Sharekhan research report, the target price of Tata Power is 245.

- According to the ICICI target price is 262.

- Anand Rathi the target price is 256

Readers also Like to Read

FIIs and DIIs are continuously decreasing their shareholding in the Tata power stock and you see the promoters from the past 4 years have increased their holding from 37.22% to 46.8%.

| Holder | Mar 2022 | Mar 2023 | Jun 2023 |

| Promoters | 46.86% | 46.86% | 46.86% |

| FIIs | 10.82% | 9.45% | 9.45% |

| DIIs | 15.89% | 14.16% | 14.59% |

| Government | 0.32% | 0.32% | 0.32% |

| Public | 26.12% | 29.21% | 28.48% |

Strengths and Weakness of the Tata Power

Strength

- The company’s past 3-year sales growth is 24%.

- In the past 5 years, the quick ratio has been 202.1% versus the industry average is 26.73%.

- In the past 5 years the current ratio has been 63.17% versus the industry average is 60.04%.

Weaknesses

- Not is a globally available

- Limited market share due to the intense competition for a Tata Power

Conclusion

Overall the company is a stable company. The financial company is stable but the company has little of that but that will be fine. companies continuously growing their sales and profit in part 3 years the company has a profit growth of 133% which is really nice moving to the renewal energy.

Disclaimer

Any target mentioned on this website is taken by our personal analysis, and we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

What is the 52-week high and low of Tata Power?

The 52-week high of Tata Power is 495 and the 52-week low is 176.65.

What is the P/E ratio of Tata Power?

The third power P/E ratio is 21.75 which means the investor is willing to pay 21 points 75 Times the company earnings per share.

What is the EPS of Tata Power?

EPS of Tata Power is 10.30 paise which means that for every rupee invested Tata Power companies are expected to earn 10.30 in profit.

What is the dividend yield of Tata Power?

Tata Power divides the Indus by 3.5%.