Currently, the stock is corrected by 30.45% from its recent high of Rs 36.02 and trading at the support zone near about Rs 27.75 previously when stock trading at this support area at that time given the move of 30% upside side.

In this article, We will understand the South Indian Bank Share Price Target 2025-2030-2040-2050. The predicted share price is based on the company’s previous performance. We also see expert opinions that will help us to understand.

Presently the South Indian Bank operates 926 branches and 1275 ATMs across India; it is heavily concentrated in the south and Kerala alone accounts for 54 percent of branches.

South Indian Bank is a private sector bank that provides retail corporate banking para banking activities such as debit card third-party financial product distribution in addition to treasury and foreign exchange business.

Key Point

- Highest ever business of 1,69,601 crores Q1 FY24

- Total deposits increased by 8% year to 95,499 crores from 88,96 crores.

- Gold loans continue to grow. please register growth of 21% year on year.

South Indian Bank Overview

South Indian Bank is a leading private sector bank in India, headquartered in Thrissur, Kerala. The bank was founded in 1929 it started with community-based banking.

Services Offered By South Indian Bank

- Offers a wide range of banking services across individual, NRI, business, and corporate segments.

- Deposits: Savings accounts, current accounts, fixed deposits, recurring deposits, etc.

- Loans: Personal loans, car loans, home loans, gold loans, education loans, commercial loans, etc.

- Investment products: Mutual funds, insurance, bonds, etc.

- Money transfers: Domestic and international remittances.

- Digital banking services: Mobile banking, internet banking, online trading, etc.

- Cash management services for businesses.

- Government business services.

| Company Name | South Indian Bank Ltd |

| Market Cap | ₹ 4,131 Cr |

| Stock P/E | 4.79 |

| Sector P/E | 14.9 |

| Debt | ₹ 92,437 Cr |

| 1 Years Returns | 152 % |

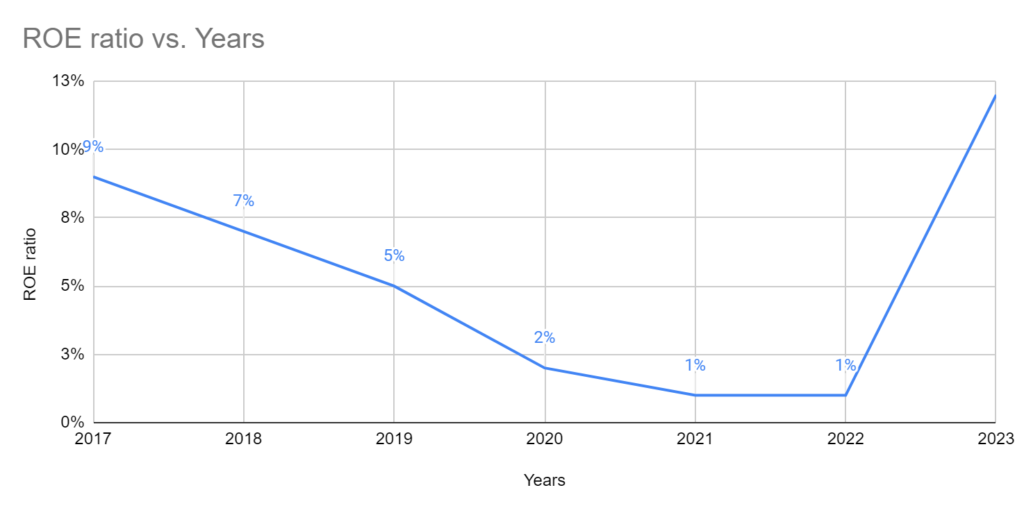

| ROE | 13.2 % |

| Profit after tax | ₹ 862 Cr. |

| 52-Week High/Low | ₹ 23.7 / 7.79 |

| Website | http://www.southindianbank.com/ |

| Stock Past Returns | ||||

| Years | Jan | Dec. | Change Price | Change % |

| 2015 | 25.69 | 16.09 | -9.6 | -59.66 |

| 2016 | 16.34 | 16.3 | -0.04 | -0.25 |

| 2017 | 16.34 | 28.48 | 12.14 | 42.63 |

| 2018 | 28.89 | 14.28 | -14.61 | -102.31 |

| 2019 | 14.38 | 9.28 | -5.1 | -54.96 |

| 2020 | 9.46 | 8.27 | -1.19 | -14.39 |

| 2021 | 8.36 | 8.13 | -0.23 | -2.83 |

| 2022 | 8.45 | 17.27 | 8.82 | 51.07 |

| 2023 | 17.68 | 24.53 | 6.85 | 27.92 |

The past 3 months’ return of South Indian Bank is 20.71% the past 6-month return is 17.28% and the one-year return is 51.84%. return as stable from stock South Indian. The company has diversified its loan book to focus on A-rated Corporate Loans. They focus more on Digital channels to drive operating efficiency.

South Indian Bank Share Price Target for 2025 could be Rs 49.74.

South Indian Bank continues reducing its NPA DEC 2023 by 1.61%. previously was 1.70%. NPA should be less because of its nonperforming assets. Past 5 years company’s net income has averaged 29.52 percent versus the industry

average of 28.23% South Indian Bank’s share price target in 2030 is Rs 190 approx.

Company corporate loans account for 30% of the total loan book followed by the business loan is 27% personal loan segment at 23% and agriculture is 20%. The company has a well-maintained loan book. South Indian Bank’s share price target in 2040 is ₹ 300 estimated.

The South Indian Bank is mostly concentrated in Kerala at 54% South Kerala is 30% the rest of India is 16%. The company is also adopting new technology from 83% to 90%. South Indian Bank’s share price target in 2050 could be reached to ₹500.

| Years | South Indian Bank Share Price Target |

| 2025 | ₹49.74 |

| 2030 | ₹190 Approx |

| 2035 | ₹230 Approx |

| 2040 | ₹300 Estimated |

| 2045 | ₹350 Estimated |

| 2050 | ₹500 Approx |

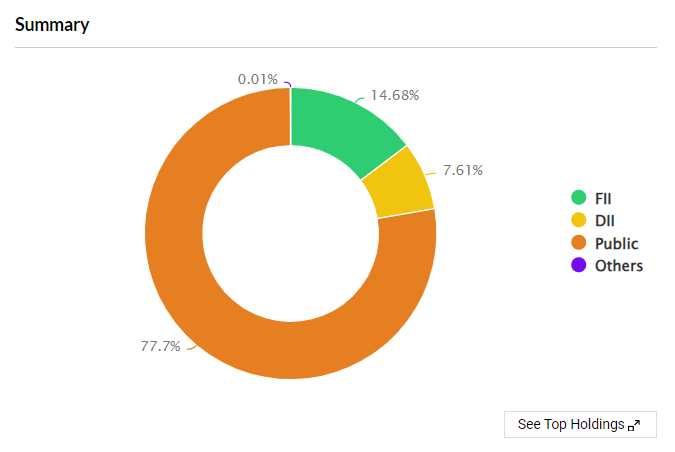

Here is a brief of the shareholding pattern of South Indian Bank.

South Indian Bank’s Strengths and Weaknesses

Strength

- Stock P/E is 4.81

- ROE is 13.2%

- Past 3-year return 41.1%

Weaknesses

- Company’s poor sales growth of 3.15% over the past 5 years.

- The bank is in a very comparative market banking sector as other major banks like HDFC Bank.

- FII reduced their holding by 0.99%.

Conclusion

South Indian Bank is mainly focused on Kerla. the bank should expand outside of the south Indian region so the company can grow better. the overall company business is growing. a company generating good revenue.

This article is for Educational purpose .Do not invest on behalf of information provided in the article. Please consult an expert before making decisions We are not SEBI registered advisor .

FAQ

What is the future of South Indian Bank stock?

According to the current scenario, the stock can go up from the current price of 24% to 25% in the next 1 year.

What is the 52-week high and low of South Indian Bank share price?

The 52-week high for South Indian banks is Rs 23.70 and the 52-week low is Rs 7.80.

What will be the share price of South Indian Bank in 2025?

South Indian Bank’s share price target in 2025 is

Share price target South Indian Bank in 2030?

South Indian Bank share price target in 2030

Is a South Indian bank a debt-free company?

Yes, the company has a debt of 92,437 crores.

What will be the share price target after 1 year of South Indian Bank?

According to the analysis, the stock price in the next year could reach ₹24 to 26 rupees.